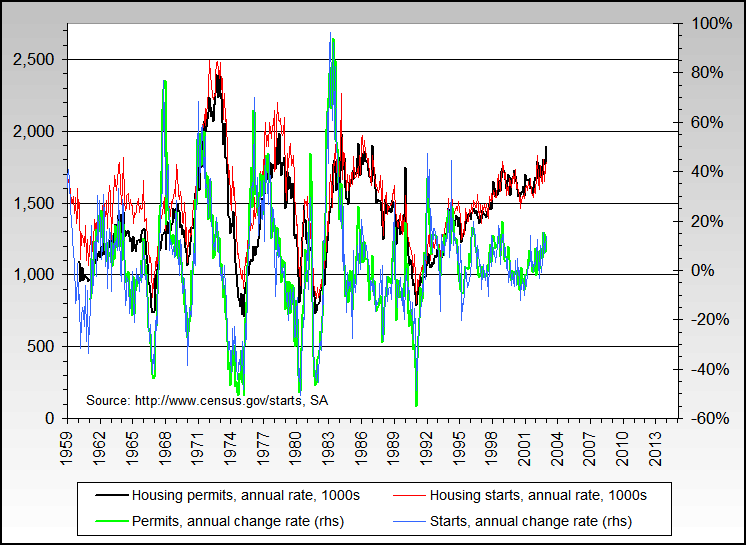

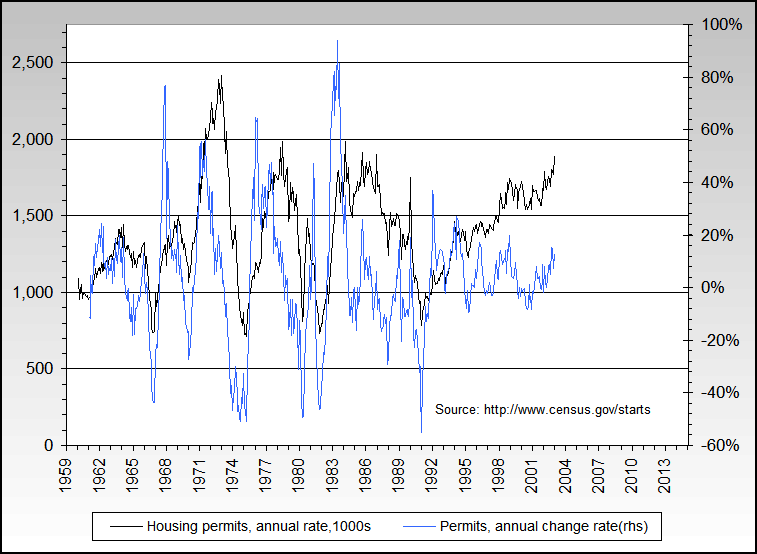

- Population growth and commercial growth at the early stage of the economic cycle, often supported by government encouragement/ low interest rates, creates an increase in the demand for housing and commercial buildings in excess of current supply.

- It takes time for construction to gear up. This construction increases demand for vacant land. Bank loans are attracted to construction and real estate sales as prices begin to rise.

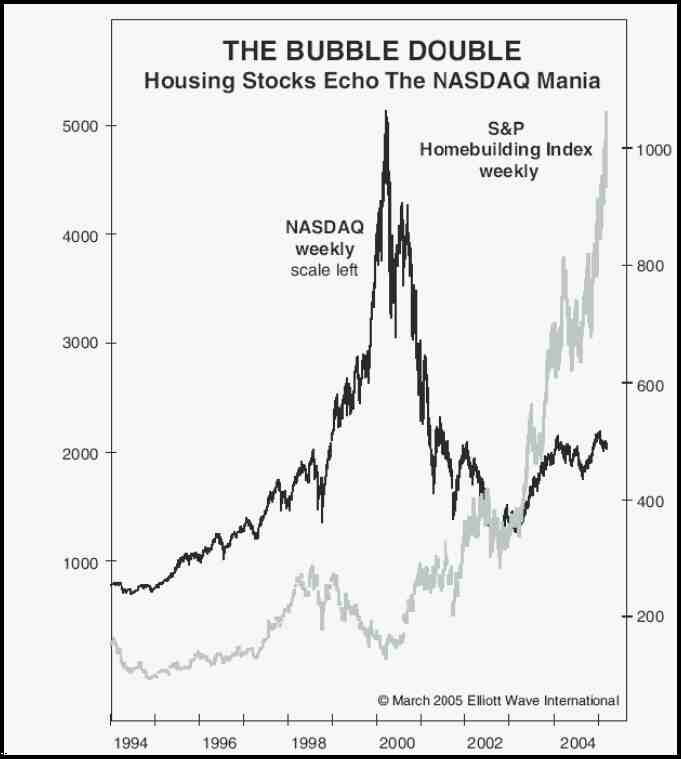

- As vacant land prices rise a boom in land develops, leading to sub-divisions and speculative resale.

- The real estate cycle peak is characterized by a high volume of subdivision and sales.

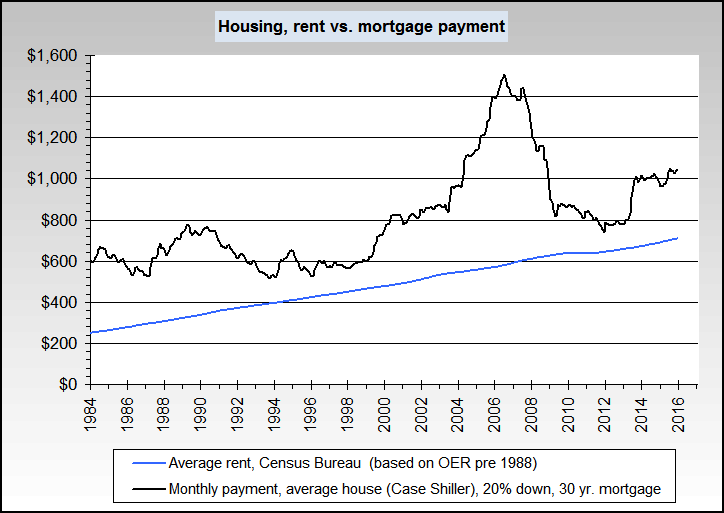

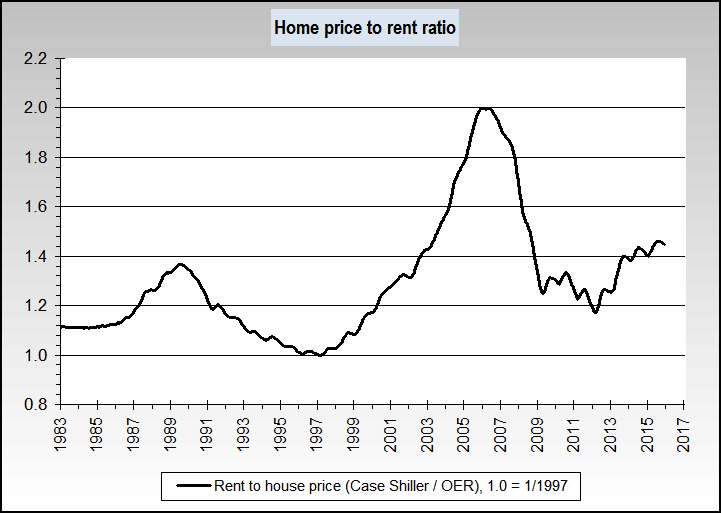

- Construction catches up with demand and a small surplus is created. Rents can't go up enough to support the higher property costs, making new construction and rental property investment unprofitable. Land values start to adjust downwards, the bubble/mania is broken.

- Rising interest rates hurt confidence and profits, adding to the downwards pressure on prices. Real estate enters a 'hanging' slow phase. Asking prices stay high but there are few buyers. Building, subdivisions, and speculation drops quickly. Sometimes a panic or crash begins at this point; often the market just slowly dies. Many keep speculating during this phase as they're unaware of the market having turned.

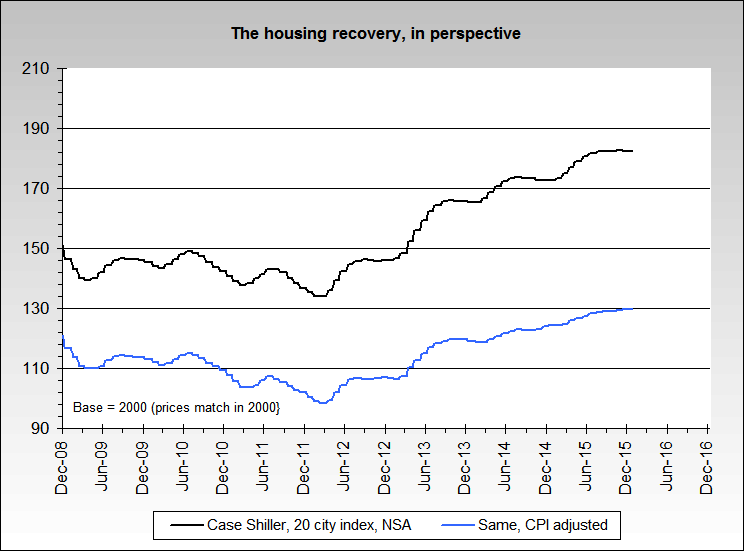

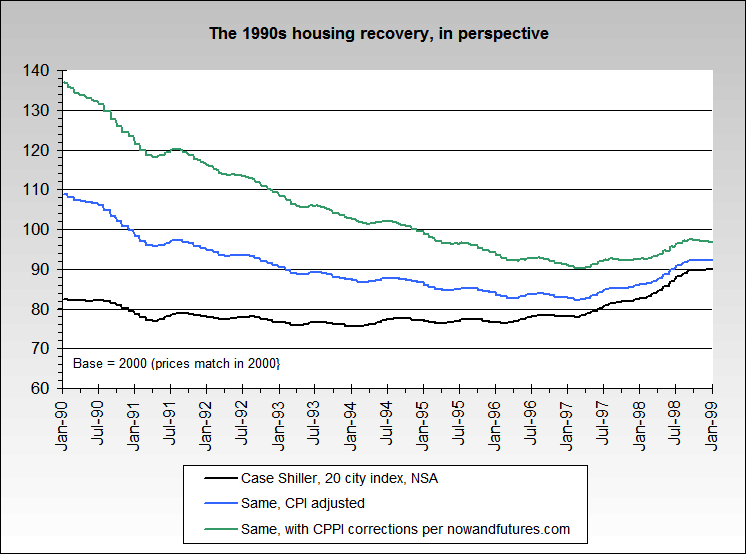

- Real estate starts to get marked down in price. This tends to take quite a while as owners tend to cling to mortgaged property longer than they would to other assets, like shares. Foreclosures rise but the foreclosure process is not quick.

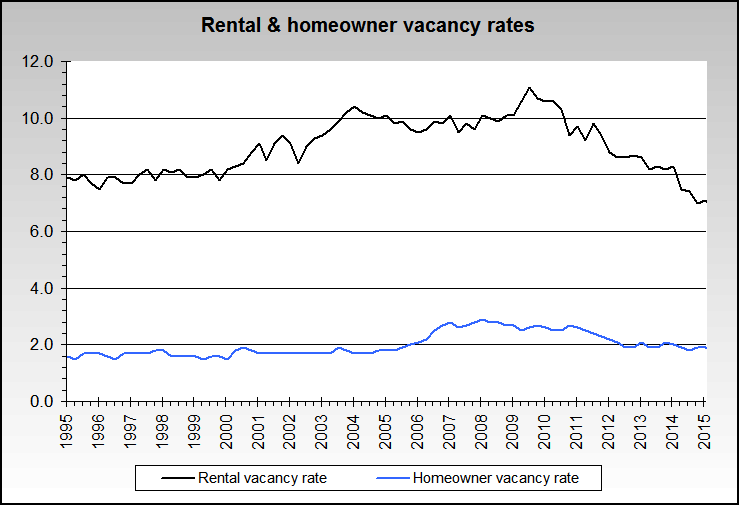

- Mortgage costs/interest rates are higher, rents decline, and vacancies increase. The market is dying rapidly. Foreclosures increase; speculators and investors are forced to sell as the capital value of their property decreases below lending margins and rents decrease below holding costs.

- The bottom of the market has the following characteristics: high vacancies, low construction rates, foreclosures and no speculation. Debt must be written off and properties sell at a deep discount. Only those who entered stage 6 with little or no debt survive to buy the dramatically discounted properties.

- Note that in a typical real estate cycle that non-residential (commercial & industrial) real estate follows residential trends with a time lag of about 5 quarters (the historical range is 3-8 quarters).

|

![]()