Management or Manipulation: The TIO Story

By bart

September 17, 2006

11/7/2007: Note that TIOs have become significantly less reliable as a US stock market bullish signal since 2nd quarter 2007, and lately (roughly mid July) have had a higher correlation with bearish effects. Whether this is a signal of a change in stance of the 22 primary dealers or not, it is an unmistakable change.

A TIO is an abbreviation for Term Investment Option, and is a way for the Treasury to make extra income.

From the treasury site here, the "Treasury will periodically auction excess operating funds to participants for a fixed term at a rate determined through a competitive bidding process."

Now for some interesting quotes, with our comments, from a few Federal Reserve members over the last 17 years:

- "The stock market is certainly not too big for the Fed to handle. The foreign exchange and government securities markets are vastly larger. Daily trading volume in the New York foreign exchange market is $130 billion. The daily volume for Treasury Securities is about $110 billion. The combined value of daily equity trading on the New York Exchange, the American Stock Exchange and the NASDAQ over-the-counter market ranges between $7 billion and $10 billion."

-- Former Federal Reserve governor, Robert Heller in the Wall Street Journal on October 27, 1989

- Governor Heller actually admits that the Fed can "handle" the stock market, way back in 1989.

- The Fed already participates in the $110 billion daily Treasury Securities market. All activity of all the stock markets is less than 10% of the size of the Treasury market.

- "An appropriate institution should be charged with the job of preventing chaos in the market: the Federal Reserve....The Fed already buys and sells foreign exchange to prevent disorderly conditions in foreign exchange markets. The Fed has assumed a similar responsibility in the market for government securities. The stock market is the only major market without a marketmaker of unchallenged liquidity or a buyer of last resort." ... "The Fed could support the stock market directly by buying market averages in the futures market, thus stabilizing the market as a whole."

-- Former Federal Reserve governor, Robert Heller in the Wall Street Journal on October 27, 1989

- Another admission by Governor Heller that the Fed, way back in 1989, assumed responsibility for preventing "disorderly conditions" in the market for treasury bonds and bills.

- He also observes the lack of a "buyer of last resort", even though the Executive Order establishing the "Working Group on Financial Markets" (also sometimes called the Plunge Protection Team, or PPT) was issued earlier in 1988. The avowed purpose of the PPT is to prevent or control a large stock market crash like what occurred in October 1987.

"Executive Order 12631 - Working Group on Financial Markets - Mar. 18, 1988; 53 FR 9421, 3 CFR, 1988 Comp., p. 559:

By virtue of the authority vested in me as President by the Constitution and laws of the United States of America, and in order to establish a Working Group on Financial Markets, it is hereby ordered as follows:

- the Secretary of the Treasury, or his designee;

- the Chairman of the Board of Governors of the Federal Reserve System, or his designee;

- the Chairman of the Securities and Exchange Commission, or his designee; and

- the Chairman of the Commodity Futures Trading Commission, or her designee. "

- A method of "supporting" the stock market via buying futures was named.

- "So the question is, having very consciously and purposely tried to break the bubble and upset the markets in order to sort of break the cocoon of capital gains speculation, we are now in a position—having done that and in a sense succeeded perhaps more than we had intended—to try to restore some degree of confidence in the System."

-- Alan Greenspan, Chairman of the Federal Reserve. Source - FOMC meeting minutes from March 22, 1994

- Oh...

- Our favorite quote from a member of the Federal Reserve.

- "In today's markets, for example, there is an increased reliance on private counterparty surveillance as the primary means of financial control. Governments supplement private surveillance when they judge that market imperfections could lead to sub-optimal economic performance.”

-- Alan Greenspan, during a Sept. 2002 speech in London entitled "Regulation, Innovation, and Wealth Creation"

- "Private counterparty surveillance"? Is this "Fed-speak" for the PPT since the Fed is actually a private organization, or perhaps for the CRMPG? Even without the benefit of a tinfoil hat, the concept of private and controlling surveillance of the market is quite disturbing.

- An admission that governments interfere ("supplement") during periods of "sub-optimal" performance, from the Maestro. We wonder who defines what is sub-optimal, at the very least, and also note that September 2002 was also the approximate bottom in the U.S. stock markets.

- The first public TIO transaction from the U.S. Treasury was in April 2002.

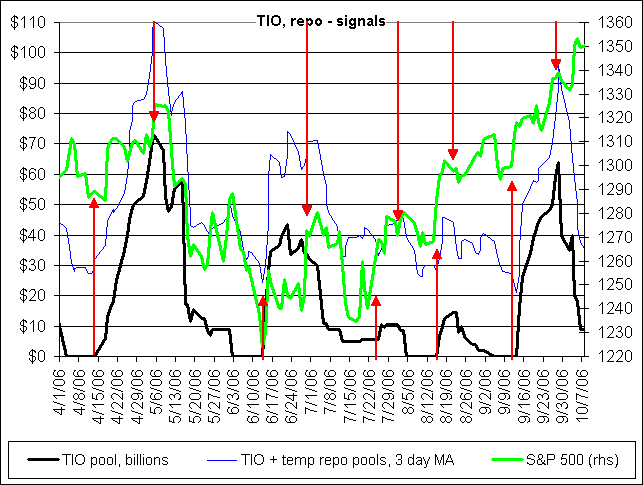

The running TIO total pool and the S&P 500, since early 2006

Just simply notice the very high correlations between the dates a TIO transaction starts and ends with the up and down moves of the S&P 500. Also note that TIOs aren't the only tool in the Fed's toolbox.

Note: graph has changed since original publication. Temporary repos (one element in Open Market Operations by which the Federal Reserve can manage or manipulate various markets) have been added for a clearer and fuller picture. TIOs are still the thick black line.

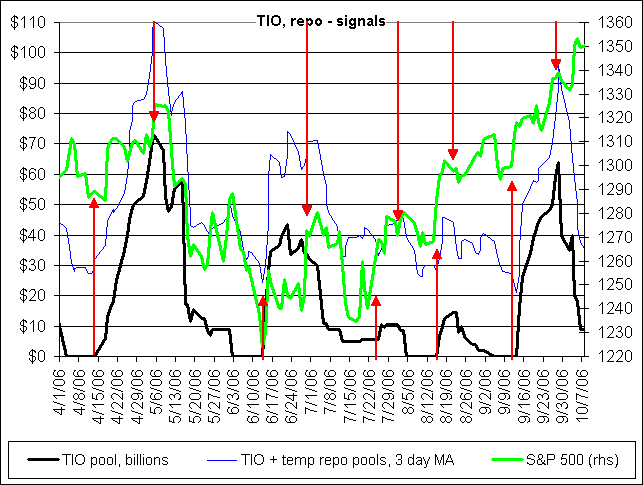

The following chart has also been added to show the actual signals more clearly.

Management or Manipulation: You decide

Securities lending, bonds & Fed intentions and hopes

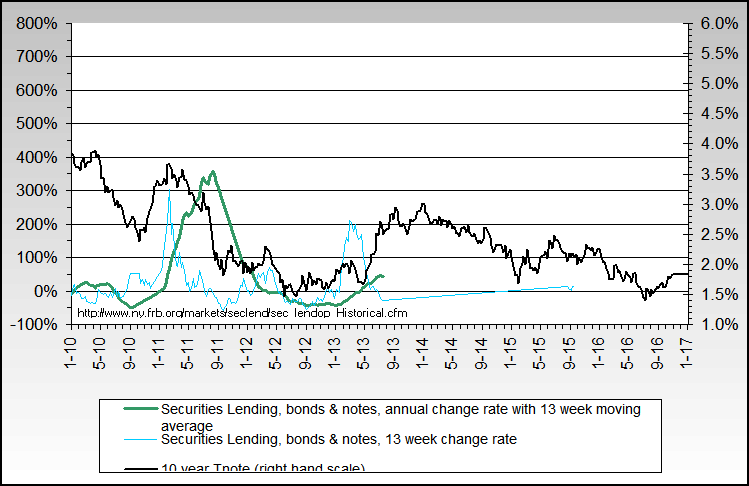

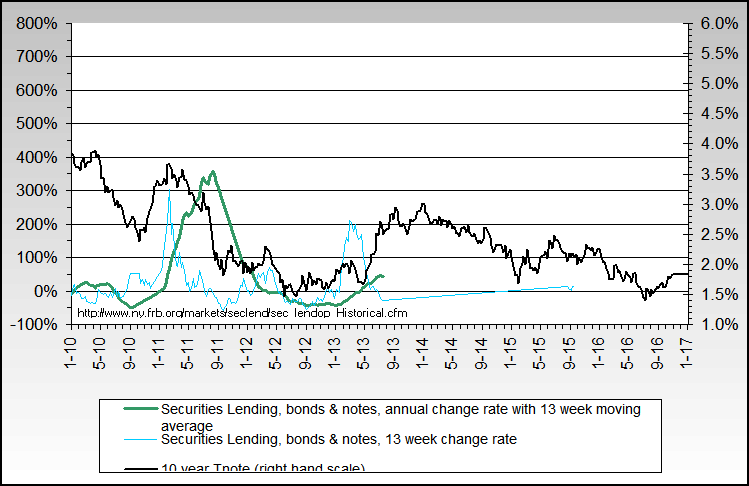

Another little known tool of the Fed used in managing interest rates is Securities lending, and it can be helpful to see what the Fed wants to have happen on the shorter term with bonds and interest rates. It’s also quite illustrative of the strong effect that the Fed has and can have on those markets. Notice how Securities Lending operations have always led changes in interest rates since 2000.

Currently, it appears to us that the Fed want rates to go back up some, probably due to the yield curve inversion.

Web site: http://www.nowandfutures.com

TIO daily chart: http://www.nowandfutures.com/daily.html

SecLend weekly chart: http://www.nowandfutures.com/fed_watch.html

![]()