FAQ - Frequently Asked Questions

... and some just plain interesting Q&A

Note: our favorite quotes have been moved to their own page.

How did you put together all those predictions?

As you can imagine, we're not going to give away all the formulas and relationships that go into them, but will say in general how it was done. We started out with the basic definition of inflation. We then applied it by locating all sorts of different goods and money data from many sources, including but not limited to all the ones mentioned in our definition of money measures. As a rough guess, about 80% of the data comes from the FRED database at the Federal Reserve site here. Then we plugged all that data into a set of huge Excel© computer spreadsheets.

Next, by a very long process of trial and error, plus adding different time lags and weights to the various numbers, we came up with the basic predictions. By weights, we mean that items like Bank Credit get a much higher weight than for example Currency since the amount of credit available is much more important to money growth than printed currency in circulation. By time lags, we mean that different types of money take differing amounts of time to get into the economy. For example again, tax refunds or Fed Open Market Operations get into the economy faster than changes in a money measure called M3 (M3 is defined in money measures).

Lastly, in order to modify the basic prediction model to match a particular market like the stock market, we did more research and located factors that specifically affect it and then added them into the prediction matrix. One example that's part of the set of stock market adjustments is program trading percentages and dollars (data available here).

The whole process started from being curious to see if the basic definition of inflation and deflation could be directly translated into predictions, and we were quite surprised at the results too. Do note that like almost anything, not only are they not 100% accurate but also eventually the formulas will cease to work well at which time we'll go back to the drawing board. Also note that there are at least two significant missing elements in all the predictions - any objective measure of human fear and any allowance for unexpected events like terrorism or calamities, etc.

(Note for folk with a large economic background: there are many adjustments and factors for more exotic methods of money creation represented by GSEs, ABSs and MBSs, hedge fund activity, fractional reserve banking, etc. There are also adjustments for GDP hedonic factors on the goods side.)

(last update mid 2005)

How is the CPI calculated and what's wrong with it?

- The offical government CPI FAQ on how its calculated, etc.

- Some of the issues we have with it under stating what is actually happening and the way its incorrectly calculated are:

- It is frequently incorrectly called or promoted or understood as a cost-of-living index, and was not designed for that purpose.

- Most taxes are not included.

- Substitutions are done when something goes up. If beef goes up and chicken doesn't for example, chicken prices are used instead of beef prices.

- On housing prices, something called "homeowners equivalent rent" is used even though over 2/3 of the people in the US live in a non-rented home, so any large increases in housing prices are not included.

- It does not attempt to measure a standard of living.

- It does not address many changes in health care, quality changes in products included, water and air quality, crime levels, consumer safety, or educational quality to name a few.

- Political bias exists to keep it lower than actual since many government payments are based on it.

- Various other statistical errors and biases.

- See hedonics, which also applies.

- Comparison of CPI rates before & after Boskin Commission changes were implemented, courtesy of Financial Sense.

- For a much more detailed discussion of this issue, see The Core Rate.

- One specific from June 2005 statistics; the CPI component for gasoline showed a 6.9% increase since June 2004, while the actual retail price was up well over 20%.

(last update mid 2005)

How does one know when to sell during a mania?

- Study past manias to help identify them. See the false data page for examples.

- Notice that prices usually go almost vertical in the last stage.

- Notice that at the peak "everybody" thinks its a sure thing.

- Notice that they can go far beyond what any rational interpretation would allow.

- Use technical analysis and especially trend lines on a price chart that represents the item.

For U.S. housing for example, the Philadelphia Housing Index and the Dow Jones REIT Index work for us.

- When the item jumps the amount of the low from which the run started in a single month, week, and then finally a single day, it's very close to the end.

How does one identify a mania?

- Extremes of popular, positive investor sentiment–the general belief that the price can only go up.

- Core Beliefs that are based on fact, such as the value of the Internet during the Internet bubble, that drive early adopters into the market.

- Apocryphal Beliefs that are later invented by those who are benefiting the most from the bubble, such as investment banks and venture capital firms during the Internet bubble, but readily accepted by everyone else who is also benefiting–to explain extreme price increases that go far beyond the level justified by the Core Beliefs.

- A well developed system of sales, marketing and distribution, that includes the mainstream press, and employs an army of analysts, consultants, lawyers, accountants, and so on, all of whom adopt first the Core Beliefs and later buy into the Apocryphal Beliefs.

- A duration that exceeds the warnings of bubble spotters by months or even years.

(from Eric Jantzen, itulip.com in this post)

How are markets manipulated?

From a Technical Analysis view, the following 50 year old quote from R.W. Schabacker, the father of modern technical analysis, applies in showing how the public can be manipulated. This is also known as chart painting.

"Insiders and professionals are by no means unaware of the growing public interest and education in chart theories and patterns. In normal trading there are certainly not enough chart traders to make it worthwhile for the professionals to play against them instead of against the general public, but we have learned that the professionals must play against someone in order to make money. It is quite conceivable, therefore, that the insiders might take a ‘crack’ at chart traders now and then by manipulating false patterns in their campaign stocks, with the knowledge that, by arranging certain chart pictures, they could draw in a certain amount of buying or selling, as they chose, with a view to strengthening their own position."

The 7 factors are required to develop a financial panic

Buoyant Growth, Systemic Architecture, Inadequate Safety Buffers, Adverse Leadership, Real Economic Shock, Fear and Greed, Failure of Collective Action.

Source - The Panic of 1807

What are the purposes of the Federal Reserve's monetary policy?

"The Federal Reserve sets the nations monetary policy to promote the objectives of maximum employment, stable prices, and moderate long term interest rates."

Source, main page here.

Also, the Fed “shall maintain long run growth of the monetary and credit aggregates commensurate with the economy’s long run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates.”

How about some basic & simple data on "peak cheap oil"?

- Peak oil does not mean running out of oil.

- Peak cheap oil does mean running out of 'inexpensive' oil.

- The planet Earth does have limited resources (they're not infinite in other words).

- Peak oil does mean that the total world production of conventional oil has occured or will occur.

- Oil companies can do nothing about increasing the actual quantity of oil available in planet Earth.

- Oil companies are neither 100% black or evil nor 100% white or good.

- In 1956, the geologist/geophysicist King Hubbert predicted that U.S. oil production would peak in the early 1970's.

- U.S. oil production peaked in 1971.

- In 1956, the geologist/geophysicist King Hubbert predicted that conventional *world* oil production would peak in roughly the period 2005-2010.

- Many facts are in dispute. Some facts are just plain unavilable and some are subject to significant "spin".

How is money created in the U.S.?

First, don't expect an easy answer. Also, don't expect that it is a fully sane or believable process either. Some of the answers below are deceptively simple, don't necessarily expect to understand them quickly.

- The system of fractional reserve banking.

- The Federal Reserve, by virtue of its ability to set certain interest rates, can encourage or discourage borrowing and therefore affect item #1.

- The Federal Reserve doing open market operations.

- Banks and the U.S. Treasury borrowing from the Federal Reserve via the Discount Rate or the Fed Funds Rate, and the Federal Reserve creates the money via a book keeping entry. Then #1 above applies. When the U.S. Treasury receives money from the Federal Reserve, this is usually also known as "monetizing the debt".

- The Federal Reserve can also affect banks needs for funds via changes in reserve requirements, directly causing an effect on the fractional reserve system. Note that bank reserves plus currency in circulation is tracked by the monetary base.

- Via tools such as the buying and selling of repos they can affect short term supply of and demand for money, and thereby affect #1.

- Loopholes in banking laws and regulations allow certain types of lending and borrowing actions that are not subject to reserve requirements or reporting or oversight, so money can be created easily and in large quantities by simply moving it around in the financial system.

- Government sponsored entities such as Fannie Mae borrow money very cheaply and then lend it out. They act similarly to a bank and item #1 applies again.

(If you're really a economics masochist and have to know details of how this is done, see Doug Noland's work here. It's called Money Market Fund Intermediation.)

- There are many other financial companies and entities and even financial instruments that act similarly to Fannie Mae.

(If you just have to know... and we really don't recommend mentally abusing yourself and also leave it up to you to find definitions and understanding but... some of them are captive finance companies such as GE Capital, Wall Street brokerage houses, credit swaps, hedge fund activities, and other quite sophisticated and complex instruments like CDOs, asset or mortgage backed securities, and SPEs. These items all fall under the general term derivatives.)

- An "outside" and indirect source, is central banks of other countries like Japan. They print their own money, and then use it to directly buy dollar denominated items from the Federal Reserve, or directly buy assets from other U.S. financial institutions.

- Organizations like the FHLB and others are far off the beaten path but do create money.

- Per the Humphrey Hawkins Act, "the Fed has the authority to buy foreign government debt, as well as domestic government debt. Potentially, this class of assets offers huge scope for Fed operations, as the quantity of foreign assets eligible for purchase by the Fed is several times the stock of U.S. government debt."

Source of the quote is a November 2002 speech by Ben Bernanke of the Fed, located here.

- There also exist some unusual and limited abilities of the Fed to directly buy certain short term financial instruments from the banks (source) to soften a crisis and aid banking liquidity.

- Note that the actual currency is printed by the US Treasury, and only distributed by the Federal Reserve System. Total currency is less than 5% of the grand total of all dollars everywhere.

- As far as the Fed's authority to create money and where it comes from: "...the testimony of Marriner Eccles before the House Committe on Banking and Currency on September 30, 1941. Marriner Eccles was the Governor of the Federal Reserve System in 1941. He is being questioned by Congressman Wright Patman about how the Fed got the money to purchase two billion dollars worth of government bonds in 1933.

ECCLES: We created it.

PATMAN: Out of what?

ECCLES: Out of the right to issue credit money.

PATMAN: And there is nothing behind it, is there, except our government's credit?

ECCLES: That is what our money system is. If there were no debts in our money system, there wouldn't be any money."

There may be other ways, but that's all we're currently aware of. They also exclude any unproven manipulation theories that exist about the Fed (see our glossary about the ESF or PPT for data about non Fed related entities).

One last point and it's mildly political. The U.S. Constitution states "The Congress shall have Power To ... coin Money, regulate the Value thereof, and of foreign Coin, and fix the Standard of Weights and Measures", so that's the source. The Federal Reserve System was created by Congress by the Federal Reserve Act of 1913, but the Federal Reserve Banks are not part of the government in spite of their name. It's a private corporation, but does at least report to Congress frequently.

(last update Nov. 2005)

How is money destroyed?

One simple way is via investment losses. The US stock market lost about $7 trillion in total value between 2000 and late 2002, and that $7 trillion was actually destroyed as of late 2002. Note that this assumes the general definition of money here.

Another would be if the Fed, during an open market operation, sold bonds in the Federal Reserve accounts back to the US Treasury without buying at least as many as they sold. Remember that when the Fed buys bonds from the Treasury during an open market operation, that creates money out of virtually thin air.

Another is losses in the banking system itself. An example is the Saving & Loan crises in the early 1990s when there were huge losses recognized by a number of Savings & Loan associations who had hugely overextended themselves - much of that money just disappeared.

If the Federal Reserve had not stepped in and provided support, the LTCM crisis in 1998 would also have destroyed a lot. Another is likely going on in early 2005 in Fannie Mae, due to some "special moments" in their accounting and financial actions since the late 1990s.

Warren Buffett, the second richest man in the world after Bill Gates, has warned repeatedly over the last few years about the dangers of derivatives, and a problem there could easily destroy many many billions.

This is not a complete list. It is just intended as examples.

(last update mid 2005)

Where's your debt clock?

Well... we don't want to copy so many other sites, but since you asked nicely - here is the direct link to the U.S. Treasury daily update for the total Treasury debt.

What is debt deflation?

Debt-Deflation

Thus governments strained their muscles to balance their budgets--thus further depressing demand--and to reduce wages and prices--in order to restore "competitiveness" and balance to their economies. In Germany the Chancellor--the Prime Minister--Heinrich Bruening decreed a ten percent cut in prices, and a ten to fifteen percent cut in wages. But every step taken in pursuit of financial orthodoxy made matters worse.

For once the declines in wages and prices in the Great Depression had passed some critical value, they knocked the economy out of its normal business-cycle pattern. Severe deflation had consequences that were much more than an amplification of the modest five to ten percent falls in prices that had been seen in past depressions.

When banks make loans, they allow beforehand for some measure of fluctuation in the value of the assets pledged as security for their loans: even some diminuation of the value of their collateral will not cause banks to panic, because if the borrower defaults they will still be able to recover their loan principal as long as the decline in the value of the collateral is not too high.

But what happens when deflation reaches the previously never seen amount of thirty, forty, or fifty percent--as it did in the Great Depression? Banks become keenly aware that their loan principal is no longer safe: that if the borrower defaults, they no longer have recourse to sufficient collateral to recover their loan principal. if the borrower defaults, and if bank depositors take the default as a signal that it is time for them to withdraw their deposits, the bank collapses.

As Keynes, wrote, once banks realize that deflation has significantly impaired the value of their collateral:

...they become particularly anxious that the remainder of their assets should be as liquid and as free from risk as it is possible to make them. This reacts in all sorts of silent and unobserved ways on new enterprise. for it means that banks are less willing than they would normally be to finance any project...

In looking at the tracks of interest rates in the Great Depression, you can see a steady widening of the gap between safe interest rates on government securities and the interest rates that borrowing companies had to pay. Even though credit was ample--in the sense that borrowers with perfect and unimpaired collateral could obtain loans at extremely low interest rates--the businesses in the economy (few of which had perfect and unimpaired collateral) found it next to impossible to obtain capital to finance investment.

Thus the banking system freezes up. It no longer performs its social function of channeling purchasing power from savers to investors. As a result private investment collapses; falling investment produces more unemployment, excess capacity, futher falls in prices, and more deflation; and further deflation renders the banking system even more insolvent.

Morever, not only past deflation but also expected future deflation depresses investment. Why invest now if you expect deflation, so that everything you would buy this year will be ten percent cheaper next year?

In the end the spiral of deflation will continue to depress the economy until something is done to restore solvency to the banking system, and break the anticipations of further falls in prices. A few economists understood this process at work during the Great Depression--Irving Fisher, John Maynard Keynes, R.G. Hawtrey--but they did not walk the corridors of power at the nadir of the Great Depression.

Source

What are the Three Laws of Motion?

- An object at rest will remain at rest unless acted on by an unbalanced force. An object in motion continues in motion with the same speed and in the same direction unless acted upon by an unbalanced force. (This law is often called "the law of inertia".)

- Acceleration is produced when a force acts on a mass. The greater the mass (of the object being accelerated) the greater the amount of force needed (to accelerate the object).

- For every action there is an equal and opposite re-action.

-- Sir Isaac Newton

What is the original Hippocratic Oath?

I swear by Apollo the Physician and Asclepius and Hygieia and Panaceia and all the gods, and goddesses, making them my witnesses, that I will fulfill according to my ability and judgment this oath and this covenant:

To hold him who has taught me this art as equal to my parents and to live my life in partnership with him, and if he is in need of money to give him a share of mine, and to regard his offspring as equal to my brothers in male lineage and to teach them this art – if they desire to learn it – without fee and covenant; to give a share of precepts and oral instruction and all the other learning to my sons and to the sons of him who has instructed me and to pupils who have signed the covenant and have taken the oath according to medical law, but to no one else.

I will apply dietic measures for the benefit of the sick according to my ability and judgment; I will keep them from harm and injustice.

I will neither give a deadly drug to anybody if asked for it, nor will I make a suggestion to this effect. In purity and holiness I will guard my life and my art.

I will not use the knife, not even on sufferers from stone, but will withdraw in favor of such men as are engaged in this work.

Whatever houses I may visit, I will come for the benefit of the sick, remaining free of all intentional injustice, of all mischief and in particular of sexual relations with both female and male persons, be they free or slaves.

What I may see or hear in the course of treatment or even outside of the treatment in regard to the life of men, which on no account one must spread abroad, I will keep myself holding such things shameful to be spoken about.

If I fulfill this oath and do not violate it, may it be granted to me to enjoy life and art, being honoured with fame among all men for all time to come; if I transgress it and swear falsely, may the opposite of all this be my lot."

-- Hippocrates Source

Well, here's (broken link, see below) the very off most folk's radar US government site, showing its progress and status. Both Mexico and Canada are actively participating.

In August 2009, the SPP website was updated to say: "The Security and Prosperity Partnership of North America (SPP) is no longer an active initiative. There will not be any updates to this site."

What can the Fed buy and sell in its Open Market Operations?

Section 14 of the Federal Reserve Act––Selected Passages Authorizing Purchases in the Open Markets SECTION 14--OPEN MARKET OPERATIONS

Purchase and Sale of Cable Transfers, Bank Acceptances and Bills of Exchange Any Federal reserve bank may, under rules and regulations prescribed by the Board of Governors of the Federal Reserve System, purchase and sell in the open market, at home or abroad, either from or to domestic or foreign banks, firms, corporations, or individuals, cable transfers and bankers' acceptances and bills of exchange of the kinds and maturities by this Act made eligible for rediscount, with or without the indorsement of a member bank. Dealings In, and Loans On, Gold

Every Federal reserve bank shall have power:

(a) To deal in gold coin and bullion at home or abroad, to make loans thereon, exchange Federal reserve notes for gold, gold coin, or gold certificates, and to contract for loans of gold coin or bullion, giving therefor, when necessary, acceptable security, including the hypothecation of United States bonds or other securities which Federal reserve banks are authorized to hold; Purchase and Sale of Obligations of United States, States, Counties, etc., and of Foreign Governments

(b)(1) To buy and sell, at home or abroad, bonds and notes of the United States, bonds issued under the provisions of subsection (c) of section 4 of the Home Owners' Loan Act of 1933, as amended, and having maturities from date of purchase of not exceeding six months, and bills, notes, revenue bonds, and warrants with a maturity from date of purchase of not exceeding six months, issued in anticipation of the collection of taxes or in anticipation of the receipt of assured revenues by any State, county, district, political subdivision, or municipality in the continental United States, including irrigation, drainage and reclamation districts, and obligations of, or fully guaranteed as to principal and interest by, a foreign government or agency thereof, such purchases to be made in accordance with rules and regulations prescribed by the Board of Governors of the Federal Reserve System. Notwithstanding any other provision of this chapter, any bonds, notes, or other obligations which are direct obligations of the United States or which are fully guaranteed by the United States as to the principal and interest may be bought and sold without regard to maturities but only in the open market.

(2) To buy and sell in the open market, under the direction and regulations of the Federal Open Market Committee, any obligation which is a direct obligation of, or fully guaranteed as to principal and interest by, any agency of the United States. Purchase and Sale of Bills of Exchange

(c) To purchase from member banks and to sell, with or without its indorsement, bills of exchange arising out of commercial transactions, as hereinbefore defined.

How about some hard facts about this Avian Flu thing?

Fast facts about avian influenza (December 2005)

What are the top five currencies in the world, ranked by amount in circulation in 2004?

- Euro

- U.S. dollar

- Japanese Yen

- China

- United Kingdom

How about the population top ten?

- China - 1,306.3

- India - 1,080.3

- European Union - 457.0

- United States - 295.7

- Indonesia - 241.9

- Brazil - 186.1

- Pakistan - 162.4

- Bangladesh - 144.3

- Russia - 143.4

- Nigeria - 128.7

Numbers in millions - July 2005 estimates, CIA factbook

What is the Communist Manifesto anyhow?

- Abolition of property in land and application of all rents of land to public purposes.

- A heavy progressive or graduated income tax.

- Abolition of all rights of inheritance.

- Confiscation of the property of all emigrants and rebels.

- Centralization of credit in the banks of the state, by means of a national bank with State capital and an exclusive monopoly.

- Centralization of the means of communication and transport in the hands of the State.

- Extension of factories and instruments of production owned by the State; the bringing into cultivation of waste-lands, and the improvement of the soil generally in accordance with a common plan.

- Equal liability of all to work. Establishment of industrial armies, especially for agriculture.

- Combination of agriculture with manufacturing industries; gradual abolition of all the distinction between town and country by a more equable distribution of the populace over the country.

- Free education for all children in public schools. Abolition of children’s factory labour in its present form. Combination of education with industrial production.

What are cognitive biases?

Many of these biases are studied for how they affect belief formation and business decisions and scientific research.

- Bandwagon effect — the tendency to do (or believe) things because many other people do (or believe) the same. Related to groupthink, herd behaviour, and manias.

- Bias blind spot — the tendency not to compensate for one's own cognitive biases.

- Choice-supportive bias — the tendency to remember one's choices as better than they actually were.

- Confirmation bias — the tendency to search for or interpret information in a way that confirms one's preconceptions.

- Congruence bias — the tendency to test hypotheses exclusively through direct testing, in contrast to tests of possible alternative hypotheses.

- Contrast effect — the enhancement or diminishment of a weight or other measurement when compared with recently observed contrasting object.

- Déformation professionnelle — the tendency to look at things according to the conventions of one's own profession, forgetting any broader point of view.

- Endowment effect — "the fact that people often demand much more to give up an object than they would be willing to pay to acquire it".[1]

- Focusing effect — prediction bias occurring when people place too much importance on one aspect of an event; causes error in accurately predicting the utility of a future outcome.

- Hyperbolic discounting — the tendency for people to have a stronger preference for more immediate payoffs relative to later payoffs, the closer to the present both payoffs are.

- Illusion of control — the tendency for human beings to believe they can control or at least influence outcomes that they clearly cannot.

- Impact bias — the tendency for people to overestimate the length or the intensity of the impact of future feeling states.

- Information bias — the tendency to seek information even when it cannot affect action.

- Irrational escalation — the tendency to make irrational decisions based upon rational decisions in the past or to justify actions already taken.

- Loss aversion — "the disutility of giving up an object is greater than the utility associated with acquiring it".[2] (see also sunk cost effects and Endowment effect).

- Neglect of probability — the tendency to completely disregard probability when making a decision under uncertainty.

- Mere exposure effect — the tendency for people to express undue liking for things merely because they are familiar with them.

- Omission bias — The tendency to judge harmful actions as worse, or less moral, than equally harmful omissions (inactions).

- Outcome bias — the tendency to judge a decision by its eventual outcome instead of based on the quality of the decision at the time it was made.

- Planning fallacy — the tendency to underestimate task-completion times.

- Post-purchase rationalization — the tendency to persuade oneself through rational argument that a purchase was a good value.

- Pseudocertainty effect — the tendency to make risk-averse choices if the expected outcome is positive, but make risk-seeking choices to avoid negative outcomes.

- Reactance - the urge to do the opposite of what someone wants you to do out of a need to reassert a perceived attempt to constrain your freedom of choice.

- Selective perception — the tendency for expectations to affect perception.

- Status quo bias — the tendency for people to like things to stay relatively the same (see also Loss aversion and Endowment effect).[3]

- Von Restorff effect — the tendency for an item that "stands out like a sore thumb" to be more likely to be remembered than other items.

- Zero-risk bias — preference for reducing a small risk to zero over a greater reduction in a larger risk.

Source

Do you have anything about the shadowy Bilderberger group that isn't from the extreme tinfoil hat brigade?

A very good short essay on "Unconscious Conspiracies".

Another interesting set of observations about tyranny, Orwell, history, etc.

What are the official missions of various Central Banks?

Federal Reserve System(Fed)

"Promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates" Source

European Central Bank (ECB)

"The main objective of the Eurosystem is to maintain price stability: safeguarding the value of the euro." Source

What do you have on conformity?

Asch's Conformity Experiment

Do you have anything on conspiracies besides Bilderberger stuff?

"The only conspiracy that matters is the conspiracy of the psychopaths against the rest of us."

Twilight of the psychopaths

America – and Western Civilization As a Whole – Was Founded On a Conspiracy Theory

The eight most dangerous jobs in the world

- Fishermen

- Pilots and airline employees

- Loggers

- Structural construction workers

- Waste management employees

- Farmers and ranchers

- Power-line technicians

- Roofers

Source

Can we please have some perspective on deaths from various causes?

- Black death - 50-75 million, approximately 25% of the known world's total population.

- Spanish flu, 1918 - 50-100 million, about 3-6% of the known world's total population.

- World War II, 55 million (U.S. share, about 400,000)

- China - Mao Zedong (1949-1975), 40 million (Nationalist or Kuomintang China, 1928-1949, about 10 million)

- Flu epidemic, 1918 - World wide, 30+ million which was 3% of the world population (estimates range from 20-100 million)(U.S. estimate is 600,000+)

- HIV/AIDs - 21 million as of 2006

- Nazi Germany, 20.9 million

- Russia - Stalin (1924-1953), 20 million (1917-1987, 61.1 million)

- World War I, 15 million

- Japan 1936-1945, about 6 million

- Holocaust - up to 6 million Jews (and many Christians, etc. too)

- Natural disasters - 1900-1999, 5+ million (floods, earthquakes, volcanoes, etc. but not including drought or famine)

- Congo War, ended in 2002 - 3.8 million

- China floods, 1931 - 3.5-4 million

- Cambodia - Pol Pot (1975-1979), 1-2 million

- Malaria - world yearly, 1+ million (out of 300+ million cases)

- Czarist Russia (1900-1917), about 1 million

- U.S. Civil War - about 600,000

- Heart (cardiovascular) disease, U.S. - about 935,000 (total U.S. deaths per year in 2010, about 2.4 million per the CDC)

- Cancer, U.S. - about 550,000 (14,400 radon lung cancer deaths - National Cancer Institute, Oster, Colditz & Kelley, 1984 [more recent data - 21,000 deaths per year])

- Flu, World - yearly 500,000+ (U\S, about 53,000 - Source)

- Hurricane/cyclone Bhola, Bangladesh 1970 - 500,000+

- Hiroshima + Nagasaki - approximately 100,000-200,000 immediate, approximately 75-100% more on the long term.

- Medical errors - U.S. only, 210,000-440,000 per year 2013 study Another source

- Prescription drugs - U.S. only, 120,000 per year (source - Death by Medicine, by Dr. Gary Null)

- Vietnam war - U.S. only, 58 thousand (excludes the approximate 140 thousand suicides) Suicide stats

- French Reign of Terror, late 1700 - 55,000.

- Auto accidents - U.S. 2004 total 42,636 (alcohol related - 16,694), 2010 total 32885, (about 32,000 total in 1931, per the Wall St. Journal.)

- Korean war - about 37,000

- Flu, U.S. - yearly average 36,000, Source

- Suicide - U.S. yearly, 30 thousand (2000)

- U.S. Revolutionary War - about 25,000

- Guns - U.S. yearly, 15 thousand (32 thousand if suicides included) (1997) (Defensive Gun Use Study, a very under reported item)

- Food poisoning in U.S. - about 3000 (CDC source)

- Swimming pool deaths in U.S. - about 3000

- 9/11/2001 - approx. 3000

- 12/7/1941 Pearl Harbor - approx. 2400

- Killer wasps - about 100

- Fireworks - 4 deaths per year in the US (over 9000 serious injuries, about 40% from fireworks banned by the CPSC), per the American Pyrotechnics Association

- Shark attacks - "During the entire year of 2001, around the world there were just 68 shark attacks, of which 4 were fatal. Not only are these numbers far lower than the media hysteria implied; they were also no higher than in earlier years or in the years to follow. Between 1995 and 2005, there were on average 60.3 worldwide shark attacks each year, with a high of 79 and a low of 46. There were on average 5.9 fatalities per year, with a high of 11 and a low of 3" Source

U.S. Center for Disease Control, 2007 figures:

- Heart disease: 631,636

- Cancer: 559,888

- Stroke (cerebrovascular diseases): 137,119

- Chronic lower respiratory diseases: 124,583

- Accidents (unintentional injuries): 121,599

- Diabetes: 72,449

- Alzheimer's disease: 72,432

- Influenza and Pneumonia: 56,326

- Nephritis, nephrotic syndrome, and nephrosis: 45,344

- Septicemia: 34,234

How about a list of countries that have had hyperinflations since 1985?

- 1982-1988, Mexico - 1000% (corrected in 1993 by a 1000:1 peso replacement)

- 1985, Bolivia - 12,000%

- 1989, Argentina - 3,000%

- 1990, Peru - 7,500%

- 1991-97, Russia - 700%

- 1993, Brazil - 2,100%

- 1993, Ukraine - 5,000%

- 1993-4, Yugoslavia - 1,000,000,000+% The Yugoslavian government's official position was that the hyperinflation occurred "because of the unjustly implemented sanctions against the Serbian people and state."

- 1999, Ecuador - 70%

- 2002, Argentina - 400%

- 2004, Zimbabwe - 133% (14 countries in 2004 had inflation rates over 15%)

- 2008 November, Zimbabwe - 6.5 sextillion percent (6.5 followed by 20 zeros)

(last update mid 2005)

The World’s Greatest Unreported Hyperinflation

What are the 4 horsemen of the Apocalypse

- Conquest

- War

- Famine

- Death

What are the worst five hyperinflations in the last 100 years?

- Hungary, 1945-1946 - 41.9 quadrillion peak percent per month (prices doubled every 15 hours)

- Zimbabwe, Nov. 2008 - prices doubling about every 17 hours.

- Yugoslavia, 10/1993-2/1994 - 5 quadrillion peak percent during the period (prices doubled every 18 hours)

- Greece, 1941-1944 - 8.5 billion peak percent per month (prices doubled every 28 hours)

- Germany, 1921-1923 - 3.25 million percent per month at its peak (prices doubled every 49 hours)

What were some of the price increases in the hyperinflation in France during 1790-1795?

- For a bushel of flour - 40 cents in 1790, increased to 45 dollars in 1795 (112x)

- For a bushel of oats - 18 cents, increased to 10 dollars (55x)

- For a cartload of wood - 4 dollars, increased to 500 dollars (125x)

- For a bushel of coal - 7 cents, increased to 2 dollars (71x)

- For a pound of sugar - 18 cents, increased to 12 ½ dollars (69x)

- For a pound of soap - 18 cents, increased to 8 dollars (44x)

- For a pound of candles - 18 cents, increased to 8 dollars (44x)

- For one cabbage - 8 cents, increased to 5½ dollars (69x)

- For a pair of shoes - 1 dollar, increased to 40 dollars (40x)

- For twenty-five eggs - 24 cents, increased to 5 dollars (21x)

What are some of the ways that governments disguise the true inflation rate?

- Just plain reporting incorrect data about money supply, rate of money creation, economic growth - i.e., lying.

- Ceasing the reporting of money supply or other important economic statistics. See here for an example.

- Altering how statistics like a Consumer Price Index are calculated (see above).

- Inventing concepts like a "core" Consumer Price Index, which excludes essential things like food and energy.

- Wage & price controls

- Favoring or encouraging redefinition of words like inflation to exclude major assets or goods from its definition.

- International currency controls, which make it more difficult to move money out of a country.

- Savings laws, designed to force people to hold money and not spend. Those will artifically and temporarily lower apparent inflation. Examples are war bonds, patriotic appeals, encouraging emergency funds, temporary taxes to discourage consumption, and the "Whip Inflation Now (W.I.N.)" program of U.S. President Ford in the mid 1970s.

- Adding limitations to a right to freely buy or sell specific items (the general case of wage & price controls or international currency controls).

- Public Relations programs to encourage incorrect, incomplete or deceptive media reporting.

What are some of the next probable financial issues or crises?

Under funded pension plans.

June 7, 2005 – Washington Post (Albert B. Crenshaw): “Although the financial markets have been on the upswing recently from their post-boom low, many of the nation's private pension plans have been sinking deeper into the hole, according to new figures from the government's pension insurance agency. The 1,108 weakest pension plans -- those whose assets are at least $50 million below the value of the benefits they promise -- were short by an aggregate $353.7 billion at the end of last year, figures from the government’s Pension Benefit Guaranty Corp. show. That was 27 percent more than the shortfall a year earlier, contrary to the hopes of many that funding would improve as the economy strengthens.”

N.Y. Times article 1

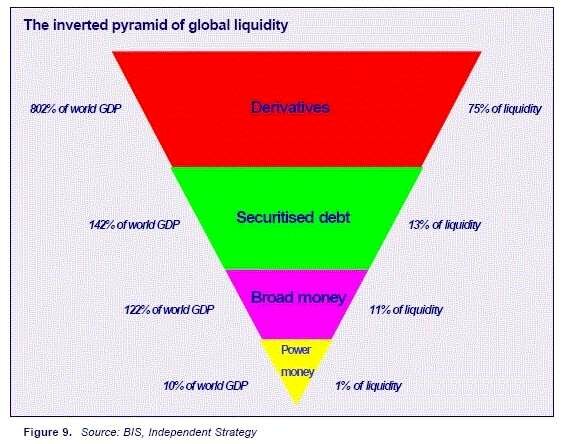

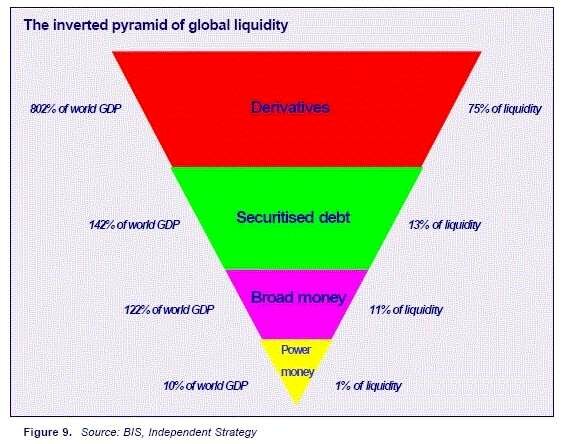

A little perspective on global liquidity, please?

We thought this was an excellent broad picture of it, although the terms used in the chart aren't very well known. Most are in our glossary though.

Anything on morality?

Obedience and Punishment Orientation

Individualism and Exchange

Good Interpersonal Relationships

Maintaining the Social Order

Social Contract and Individual Rights

Universal Principles

KOHLBERG'S STAGES OF MORAL DEVELOPMENT

Medicaid drug bill

The Medicaid drug bill due to go into effect in January 2006 is part of the the overall massive problem with US budget deficits and government spending. It is estimated to cost about $150-200 billion per year. Add in $150+ billion of off budget spending for Iraq, another probable $150+ billion for Katrina and other hurricanes, the existing $350+ billion official deficit and the longer term outlook for inflation and the strength of the US dollar becomes less than optimistic.

Derivatives

Warren Buffett, the second wealthiest man in the U.S., has stated that derivatives are the WMD of financial markets. Also see "The Derivative Conundrum" by Jim Sinclair, his letter to the Chairman of the Federal Reserve warning about the area. (Derivative definition)

Alternative Minimum Tax

Another that has received little coverage in any of the media is changes in how the alternative minimum tax (AMT) will be implemented starting in 2006. The Congressional Budget Office has estimated that it will affect an additional 20-25 million tax returns between 2006-2010, and is expected to raise about $80 billion in revenues. It will more than offset any of the tax breaks enacted in the years since 9/11.

(last update mid 2005)

Is there a counterpoint to the CERA report bashing 'peak oil'?

Right here.

What nations have the most popular brands?

- Australia

- Canada

- Switzerland

- UK

- Sweden

- Italy

- Germany

- Netherlands

- France

- New Zealand

- United States

- Spain

- Ireland

- Japan

- Brazil

- Mexico

- Egypt

- India

- Poland

- South Korea

- China

- South Africa

- Czech Republic

- Russia

- Turkey

Source: GMI Poll, August 2005

Top brands of 2005

What was it like right before the Great Depression?

Here is a short two page article from the August 1929 issue of "Ladies Home Journal", a publication not exactly known for investment advice, entitled "Everybody ought to be rich". (requires Adobe Acrobat to display)

Also, here is a PBS transcipt of their show "The Crash of 1929".

What would the Fed do during a crisis with Fannie Mae or any GSE?

"Under Section 13(3) of the Federal Reserve Act, Federal Reserve Banks have the authority to discount paper for individuals, partnerships or corporations. Direct lending to the GSEs would have to come under provisions of this part of the Federal Reserve Act. Critical provisions include a finding of unusual and exigent circumstances and an affirmative vote of not less than five members of the Board of Governors. The loans would have to be fully collateralized." Source: Panel on Government Sponsored Enterprises

Nuclear power, good or bad or in between?

Some good and useful data at Wikipedia

CEO Pay vs. the Average Employee?

"In 1982, the ratio between chief executives and the average employee was 42:1. In 2004, the ratio of the average CEO pay to that of the average non-management worker in the US was 431:1."

Source: Speech by SEC Commissioner Roel C. Campos, Feb. 13th 2006

Is Earth safe?

Two answers - No, and it varies over time regarding safety.

More than 2.5 billion people were affected by floods, earthquakes, hurricanes and other natural disasters between 1994 and 2003, a 60 percent increase over the previous two 10-year periods, U.N. officials reported at a conference on disaster prevention in January. Those numbers don't include millions displaced by last December 2004's tsunami, which killed an estimated 180,000 people as its monstrous waves swept over coastlines from Indonesia's Aceh province to Trincomalee, Sri Lanka, and beyond. By another measure -- property damage -- 2004 was the costliest year on record for global insurers, who paid out more than $40 billion on natural disasters, reports German insurance giant Munich Re. Florida's quartet of 2004 hurricanes was the big factor. But generally it's not that more "events" are happening, rather that more people are in the way, said Thomas Loster, a Munich Re expert. "More and more people are being hit," he said. One third of the world’s population lives within 100 km (about 62 miles) of the ocean – thirteen of the eighteen ‘mega cities’ in the world are by the sea.

What's with this tinfoil hat thing?

From the tongue-in-cheek department:

On the Effectiveness of Aluminium Foil Helmets

Mind control (The Tinfoil Hat Song)

Wikipedia entry

Buy one

Build your own

...evil laugh

What are the 5 steps to persecute or shut down a group or idea?

- Identify the group or idea

- Marginalize it via various P.R., propaganda and other tools, including the redefinition of specific words

- Vilify (make vicious and defamatory statements about) the group or idea

- Make laws against it

- Enforce the laws

Is it really worse now?

- Movies "This new form of entertainment has gone far to blast maidenhood ... Depraved adults with candies and pennies beguile children with the inevitable result. The Society has prosecuted many for leading girls astray through these picture shows, but GOD alone knows how many are leading dissolute lives begun at the 'moving pictures.'"

- The Annual Report of the New York Society for the Prevention of Cruelty to Children, 1909

- Telephone "Does the telephone make men more active or more lazy? Does [it] break up home life and the old practice of visiting friends?"

- Survey conducted by the Knights of Columbus Adult Education Committee, San Francisco Bay Area, 1926

- Comic books "Many adults think that the crimes described in comic books are so far removed from the child's life that for children they are merely something imaginative or fantastic. But we have found this to be a great error. Comic books and life are connected. A bank robbery is easily translated into the rifling of a candy store. Delinquencies formerly restricted to adults are increasingly committed by young people and children ... All child drug addicts, and all children drawn into the narcotics traffic as messengers, with whom we have had contact, were inveterate comic-book readers This kind of thing is not good mental nourishment for children!"

- Fredric Wertham, Seduction of the Innocent, 1954

- War This war is a defensive war. It was forced upon us by our enemies, who wish to destroy our nation. The only thing we cannot afford to lose in this war is our freedom, the foundation of our life and our future. No one has the right to complain about limitations on his personal freedom caused by the war.

…

Why of course the people don’t want war. But it is the leaders who determine policy, and it is always a simple matter to drag the people along. All you have to do is tell them they are being attacked, and denounce the peacemakers for lack of patriotism and exposing the country to danger. It works the same in any country.

-- Joseph Goebbels, Sept 1943 (source - http://www.calvin.edu/academic/cas/gpa/goeb45.htm)

- Rock and Roll "The effect of rock and roll on young people, is to turn them into devil worshippers; to stimulate self-expression through sex; to provoke lawlessness; impair nervous stability and destroy the sanctity of marriage. It is an evil influence on the youth of our country."

- Minister Albert Carter, 1956

- The Waltz "The indecent foreign dance called the Waltz was introduced ... at the English Court on Friday last ... It is quite sufficient to cast one's eyes on the voluptuous intertwining of the limbs, and close compressure of the bodies ... to see that it is far indeed removed from the modest reserve which has hitherto been considered distinctive of English females. So long as this obscene display was confined to prostitutes and adulteresses, we did not think it deserving of notice; but now that it is ... forced on the respectable classes of society by the evil example of their superiors, we feel it a duty to warn every parent against exposing his daughter to so fatal a contagion."

- The Times of London, 1816

- Novels "The free access which many young people have to romances, novels, and plays has poisoned the mind and corrupted the morals of many a promising youth; and prevented others from improving their minds in useful knowledge. Parents take care to feed their children with wholesome diet; and yet how unconcerned about the provision for the mind, whether they are furnished with salutary food, or with trash, chaff, or poison?"

- Reverend Enos Hitchcock, Memoirs of the Bloomsgrove Family, 1790

- Lincoln on the Declaration of Independence [regarding the framers of the Declaration of Independence]: "These communities, by their representatives in old Independence Hall, said to the whole world of men: "We hold these truths to be self-evident: that all men are created equal; that they are endowed by their Creator with certain unalienable rights; that among these are life, liberty and the pursuit of happiness." This was their majestic interpretation of the economy of the Universe. This was their lofty, and wise, and noble understanding of the justice of the Creator to His creatures. [Applause.] Yes, gentlemen, to all His creatures, to the whole great family of man. In their enlightened belief, nothing stamped with the Divine image and likeness was sent into the world to be trodden on, and degraded, and imbruted by its fellows. They grasped not only the whole race of man then living, but they reached forward and seized upon the farthest posterity. They erected a beacon to guide their children and their children's children, and the countless myriads who should inhabit the earth in other ages. Wise statesmen as they were, they knew the tendency of prosperity to breed tyrants, and so they established these great self-evident truths, that when in the distant future some man, some faction, some interest, should set up the doctrine that none but rich men, or none but white men, were entitled to life, liberty and the pursuit of happiness, their posterity might look up again to the Declaration of Independence and take courage to renew the battle which their fathers began -- so that truth, and justice, and mercy, and all the humane and Christian virtues might not be extinguished from the land; so that no man would hereafter dare to limit and circumscribe the great principles on which the temple of liberty was being built."

- Speech at Lewistown, Illinois, on August 17, 1858 (CWAL II:546)

What is the 'Doomsday Clock'?

The Bulletin of the Atomic Scientists has informed the world what time it is since 1947, when its now-famous "Doomsday Clock" first appeared of the cover of the magazine. Since then, the minute hand of the clock has moved forward and back to reflect the global level of nuclear danger and the state of international security.

The full timeline.

The current time.

The Wikipedia entry.

Please list some unusual monetary "solutions"

Monetary Policy Alternatives at the Zero Bound

"An Empirical Assessment (non-technical summary page i) In this paper, we apply the tools of modern empirical finance to the recent Experiences of the United States and Japan to provide evidence on the potential Effectiveness of various nonstandard policies. Following Bernanke and Reinhart (2004), we group these policy alternatives into three classes: (1) using communications policies to shape public expectations about the future course of interest rates; (2) increasing the size of the central bank's balance sheet, or "quantitative easing"; and (3) changing the composition of the central bank's balance sheet through, for example, the targeted purchases of long-term bonds as a means of reducing the long-term interest rate."

Source

Is there a connection between economics, investing and psychiatry?

Some thoughts here on stimulus/response. A bit 'out there' but still food for thought.

What are the 7 Christian Virtues

Courage, prudence, justice, and temperance, plus the theological ones of faith, hope, and charity.

In more classical views, they are chastity (Latin, virtus), abstinence (Latin, frenum), liberality (Latin, liberalitas), diligence (Latin, industria), patience (Latin, patientia), kindness (Latin, humanitas) and humility (Latin, humilitas).

What are the 7 Christian Deadly Sins

The generally accepted deadly sins are superbia (hubris/pride), avaritia (avarice/greed), luxuria (extravagance, later lust), invidia (envy), gula (gluttony), ira (wrath), and acedia (sloth)

In the probably better known than left mysterious department, what would happen if a nuclear bomb hit your city?

This link only shows a limited number of specific U.S. cities, but if you know your longitude & latitude it will show your location. Find your longitude and latitude.

To the best of our knowledge, "suitcase" nuclear devices are around 10 kiloton and the "average tactical nuclear bomb" is 100 kiloton. A kiloton is equivalent to 1000 tons of dynamite.

How about a quote from Hitler, early in his career?

"My feelings as a Christian points me to my Lord and Savior as a fighter. It points me to the man who once in loneliness, surrounded by a few followers, recognized these Jews for what they were and summoned men to fight against them and who, God's truth! was greatest not as a sufferer but as a fighter. In boundless love as a Christian and as a man I read through the passage which tells us how the Lord at last rose in His might and seized the scourge to drive out of the Temple the brood of vipers and adders. How terrific was His fight for the world against the Jewish poison. To-day, after two thousand years, with deepest emotion I recognize more profoundly than ever before the fact that it was for this that He had to shed His blood upon the Cross. As a Christian I have no duty to allow myself to be cheated, but I have the duty to be a fighter for truth and justice... And if there is anything which could demonstrate that we are acting rightly it is the distress that daily grows. For as a Christian I have also a duty to my own people."

--Adolf Hitler, in a speech on 12 April 1922 (Norman H. Baynes, ed. The Speeches of Adolf Hitler, April 1922-August 1939, Vol. 1 of 2, pp. 19-20, Oxford University Press, 1942)

Feel free to substitute any other group for the word "Jews" above. We think that doing that can add perspective, and frequently more truth, to any age or time.

What legal powers does the Federal Reserve actually have?

(long & technical)

The Federal Reserve Act specifically identifies the types of securities the central bank is allowed to buy and sell. These include Treasuries, agencies, short-duration municipal bonds, bankers’ acceptances, and gold (the US was under a gold standard when the Fed was established in 1913). After a long and contentious debate over its legality, the Fed in 1962 also "reinterpreted" Section 14 of the Federal Reserve Act as giving it the legal authority to buy and sell foreign currencies (see Robert L. Hetzel’s paper "Sterilized Foreign Exchange Intervention: The Fed Debate in the 1960s" in the spring 1996 issue of the Richmond Fed’s Economic Quarterly for background on the debate and legal arguments advanced by Fed and Treasury lawyers justifying currency intervention). Subsequently, in 1980, the Congress gave the Fed legal authority to invest the proceeds of foreign exchange operations in short-term foreign government bonds.

However, the Fed clearly has no legal authority to buy equities or corporate bonds, and no reasonable interpretation of the Federal Reserve Act would give them that right. Indeed, when the Fed began to consider changes to System Open Market Account (SOMA) procedures a couple of years ago in response to concerns about a shrinking supply of Treasuries, it acknowledged that a change in the law would be required to go beyond the securities listed above. In the interim, it investigated expanding its outright purchases to include GNMA MBS, and their repo operations, to include munis and foreign government bonds, because these securities were "assets that could be purchased under existing legal authority but were not currently authorized by the Committee" (see the January 2001 FOMC minutes). Moreover, in his February 2001 Humphrey-Hawkins testimony explaining the Fed's investigation of these possibilities, Fed Chairman Greenspan acknowledged that any further steps would require that the FOMC "request the Congress for a broadening of its statutory authority for acquiring assets via open market operations." Clearly, the Fed is a long way from having the legal authority to operate in equity markets. The conspiracy theorists are going to have to look elsewhere for an explanation of the recent market gyrations.

The relevant section of the Federal Reserve Act is as follows:

"Section 14. Any Federal reserve bank may, under rules and regulations prescribed by the Federal Reserve Board, purchase and sell in the open market, at home or abroad, either from or to domestic or foreign banks, firms, corporations, or individuals, cable transfers and bankers' acceptances and bills of exchange of the kinds and maturities by this Act made eligible for rediscount, with or without the endorsement of a member bank.

Every Federal reserve bank shall have power: (a) To deal in gold coin and bullion at home or abroad, to make loans thereon, exchange Federal reserve notes for gold, gold coin, or gold certificates, and to contract for loans of gold coin or bullion, giving therefor, when necessary, acceptable security, including the hypothecation of United States bonds or other securities which Federal reserve banks are authorized to hold; (b) to buy and sell, at home or abroad, bonds and notes of the United States, and bills, notes, revenue bonds, and warrants with a maturity date of purchase of not exceeding six months, issued in anticipation of the collection of taxes or in anticipation of the receipt of assured revenues by any State, county, district, political subdivision, or municipality in the continental United States, including irrigation, drainage, and reclamation districts, such purchases to be made in accordance with rules and regulations prescribed by the Federal Reserve Board; (c) to purchase from member banks and to sell, with or without its endorsement, bills of exchange arising out of commercial transactions, as hereinbefore defined; (d) to establish from time to time, subject to review and determination of the Federal Reserve Board, rates of discount to be charged by the Federal reserve bank for each class of paper, which shall be fixed with a view of accommodating commerce and business; (e) to establish accounts with other Federal reserve banks for exchange purposes and, with the consent of the Federal Reserve Board, to open and maintain banking accounts in foreign countries, appoint correspondents, and establish agencies in such countries wheresoever it may deem best for the purpose of purchasing, selling, and collecting bills of exchange, and to buy and sell with or without its endorsement, through such correspondents or agencies, bills of exchange arising out of actual commercial transactions which have not more than ninety days to run and which bear the signature of two or more responsible parties."

Section 14b was amended in the Monetary Control Act of 1980 to expressly grant the Fed the authority to invest in "short-term foreign government securities," though the Fed’s questionable legal basis for acquiring foreign currency in the first place has never been remedied by Congressional legislation.

Source: Morgan Stanley

The Fed is allowed to buy certain short-term private instruments, such as bankers' acceptances, that are not much used today. It is also permitted to make IPC (individual, partnership, and corporation) loans directly to the private sector, but only under stringent criteria. This latter power has not been used since the Great Depression but could be invoked in an emergency deemed sufficiently serious by the Board of Governors.

...

Therefore a second policy option, complementary to operating in the markets for Treasury and agency debt, would be for the Fed to offer fixed-term loans to banks at low or zero interest, with a wide range of private assets (including, among others, corporate bonds, commercial paper, bank loans, and mortgages) deemed eligible as collateral ( By statute, the Fed has considerable leeway to determine what assets to accept as collateral.). For example, the Fed might make 90-day or 180-day zero-interest loans to banks, taking corporate commercial paper of the same maturity as collateral. Pursued aggressively, such a program could significantly reduce liquidity and term premiums on the assets used as collateral. Reductions in these premiums would lower the cost of capital both to banks and the nonbank private sector, over and above the beneficial effect already conferred by lower interest rates on government securities.

...

... the Fed could of course always go to the Congress to ask for the requisite powers to buy private assets.

Source

Federal Reserve Act of 1913, in full

(Not strictly part of the Fed itself, but interesting nonetheless)

"The shocking revelation yesterday that governors of the Federal Reserve system are free to trade in US equities - and one would assume US Treasuries - is another slice off the confidence block."

Source, editorial of Tuesday, October 25, 2005, 7:46:00 PM EST

(last update Oct 2005)