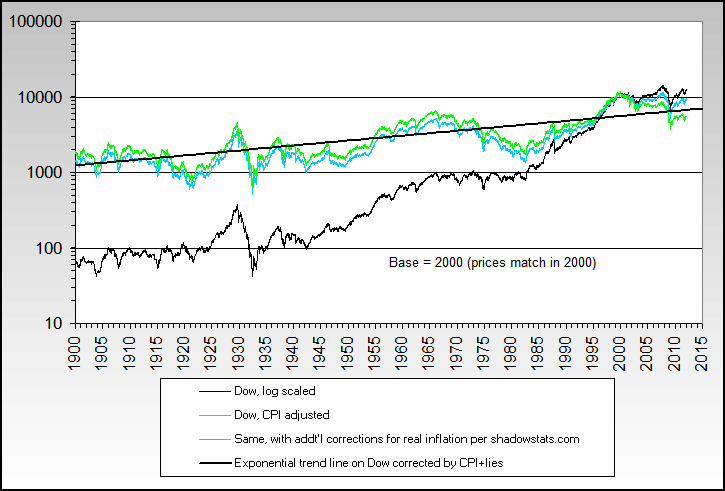

Same, but going back to 1900

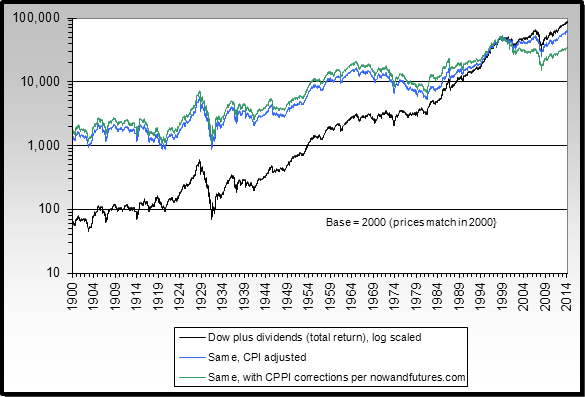

Dow stock index, total return including dividends

The average compounded total return per year through 2007 is about 6.5%. When corrected by CPI, it's about 3.4%... and with full with CPI+lies corrections included, its about 2.8%. In other words, almost 60% of the total return is inflation only... and that's before fees, commissions and taxes.

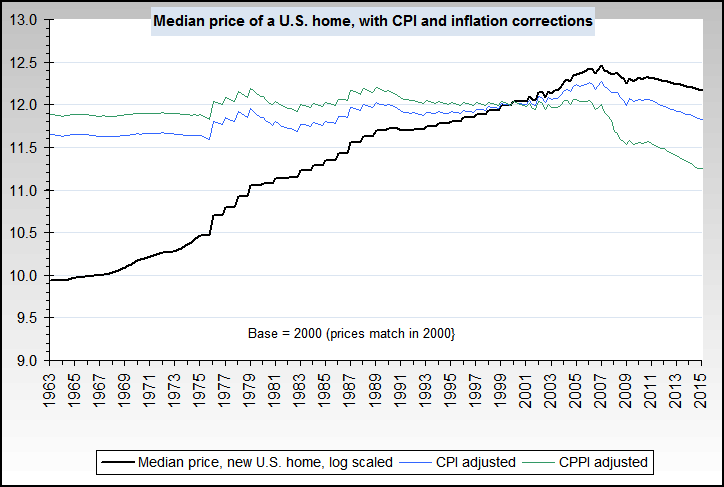

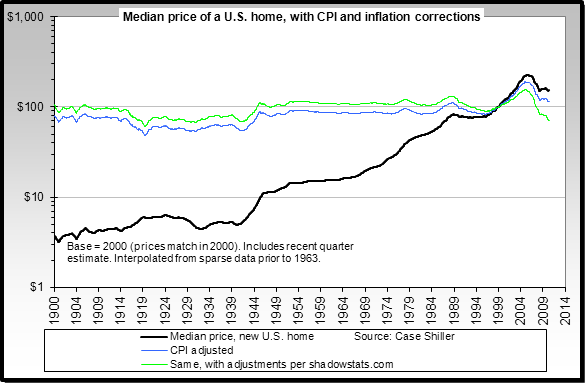

U.S. median new home prices

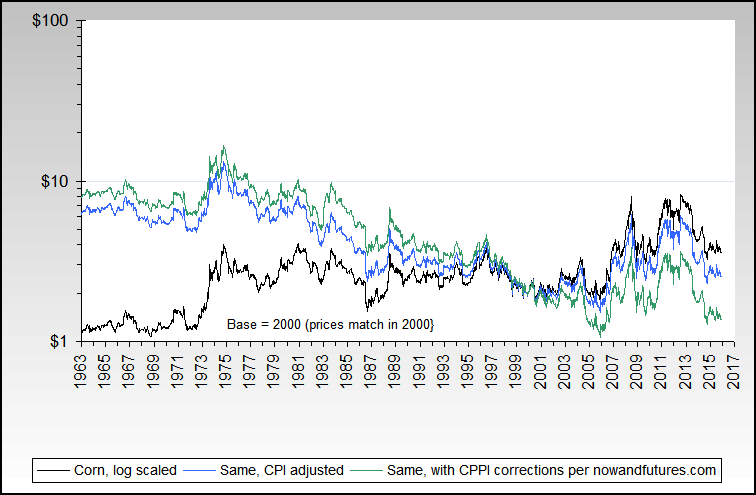

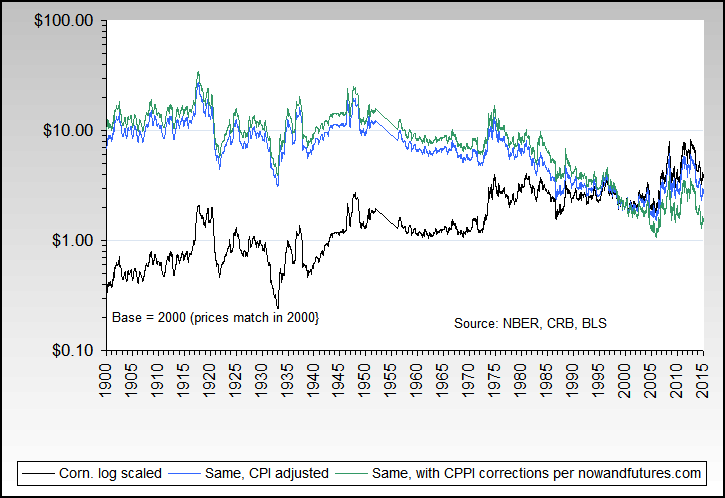

Corn

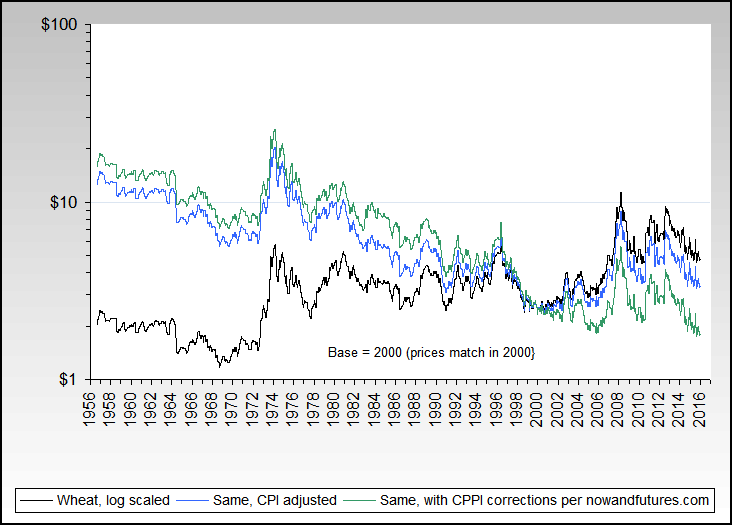

Wheat

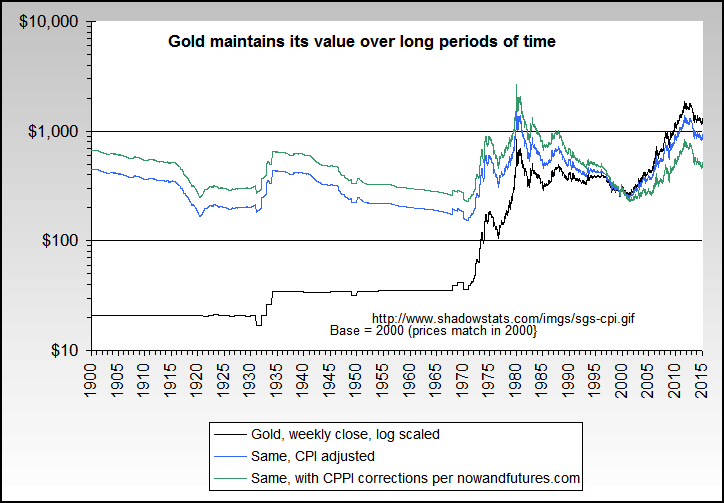

Gold

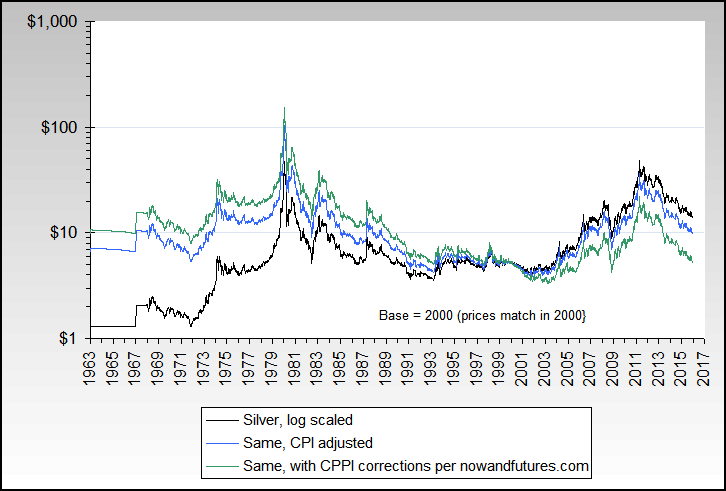

Silver

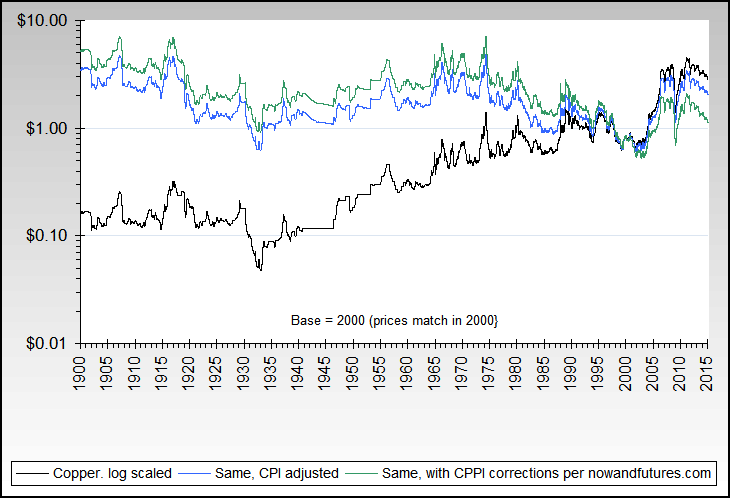

Copper

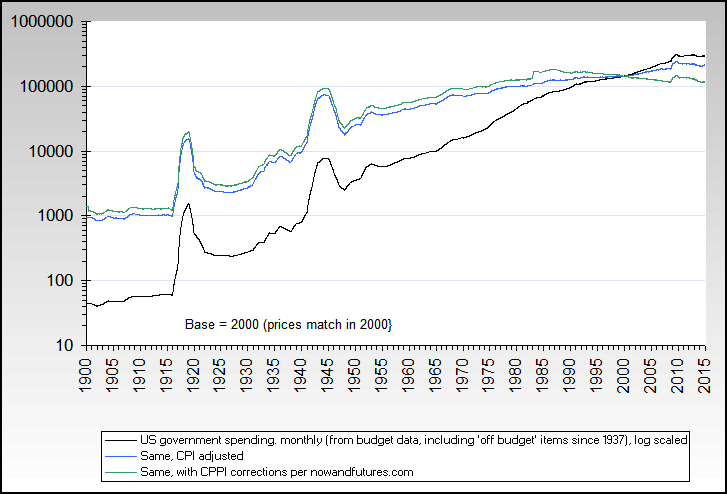

US Federal government spending

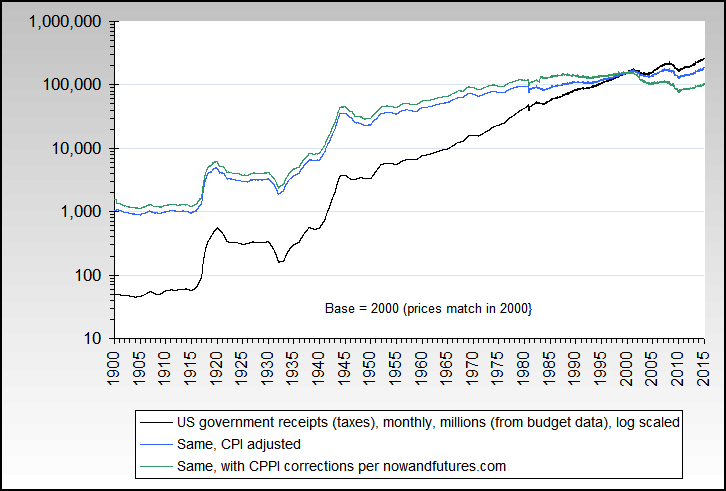

US Federal government receipts (taxes)

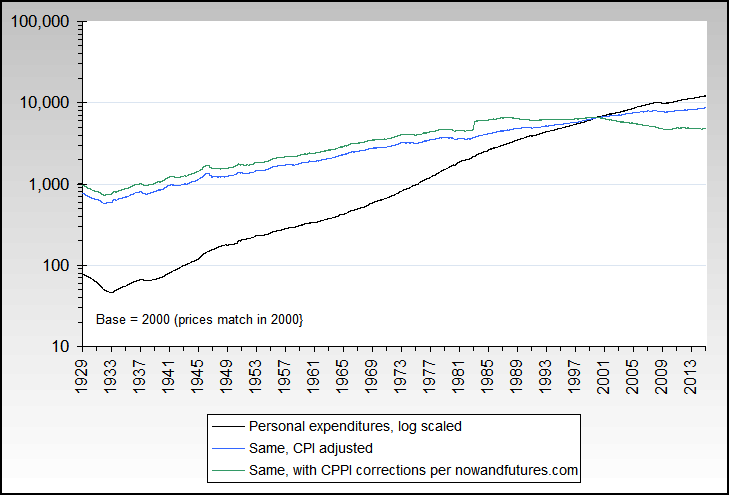

Personal consumption & expenditures (PCE)

Total U.S. Household net worth

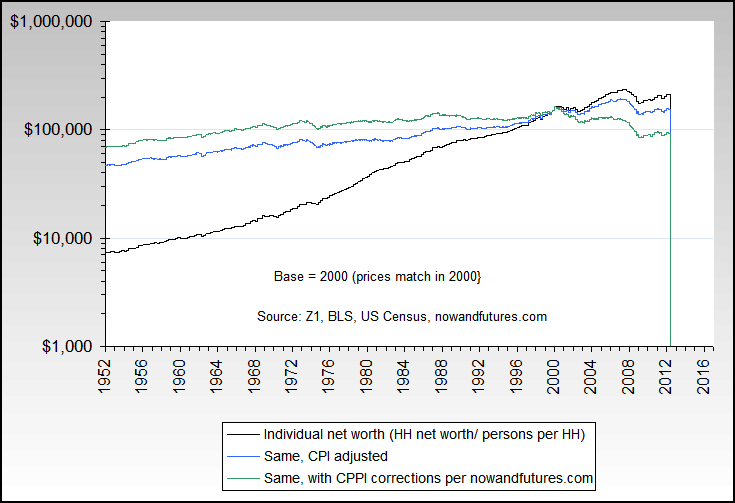

U.S. individual net worth

CRB commodity index

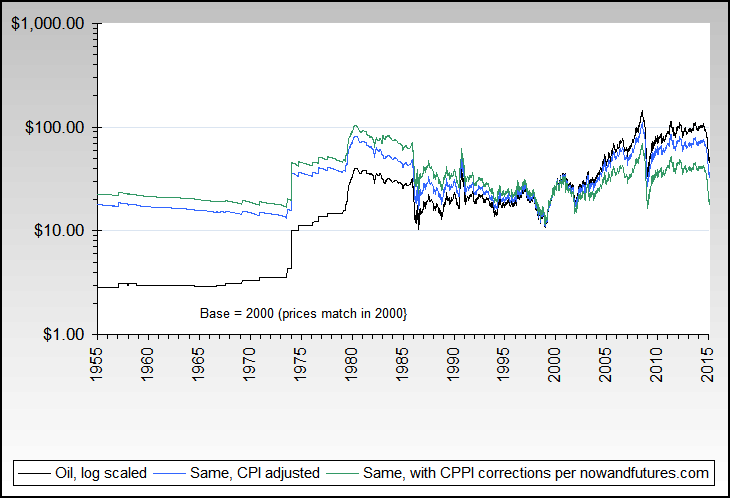

Oil

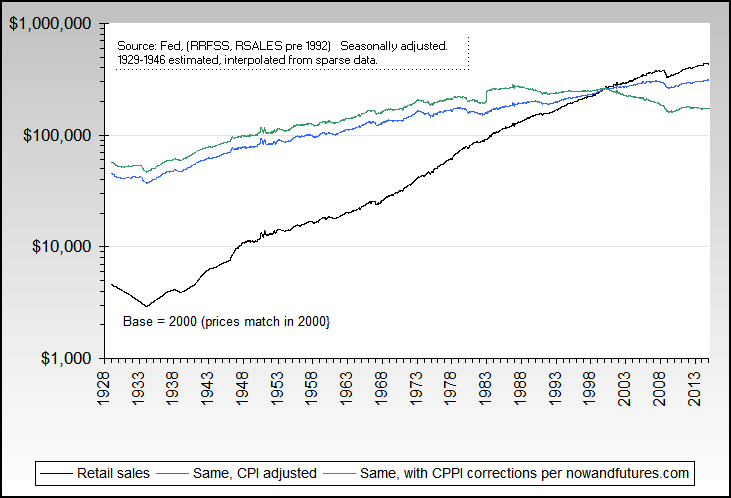

U.S. retail sales

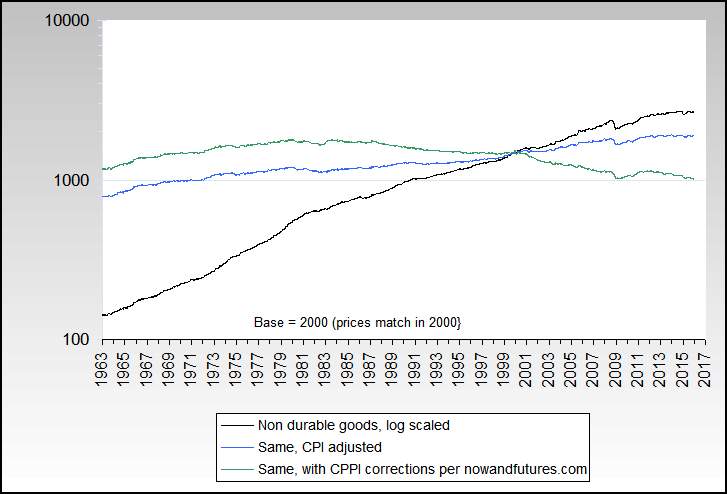

U.S. non durable goods

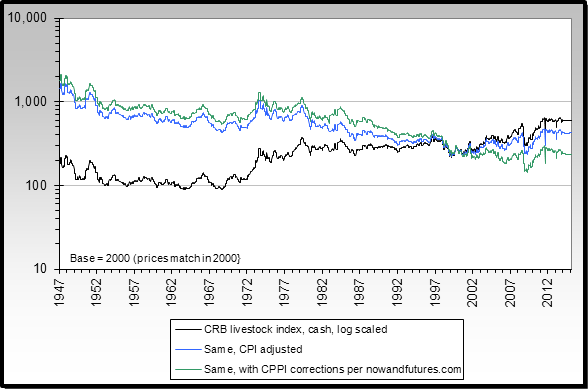

CRB Livestock Index

CRB Foodstuff Index

Sugar

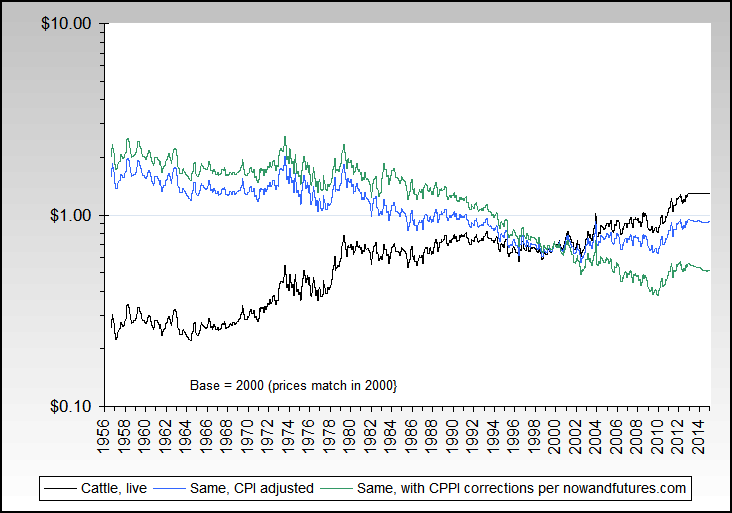

Cattle

Employment cost index

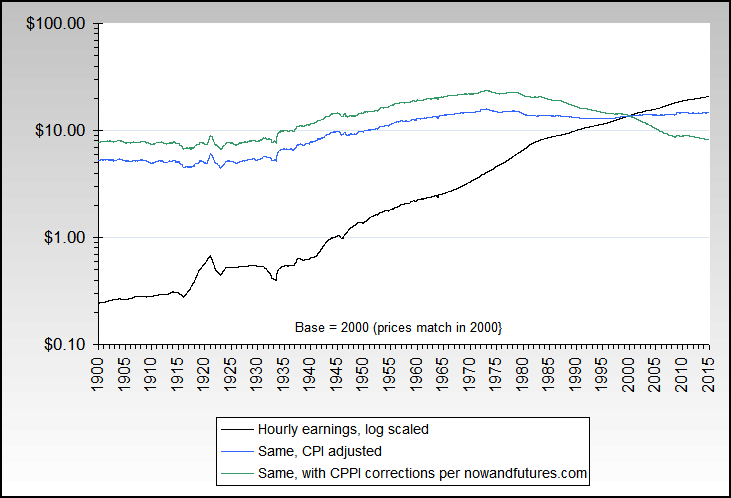

Hourly earnings

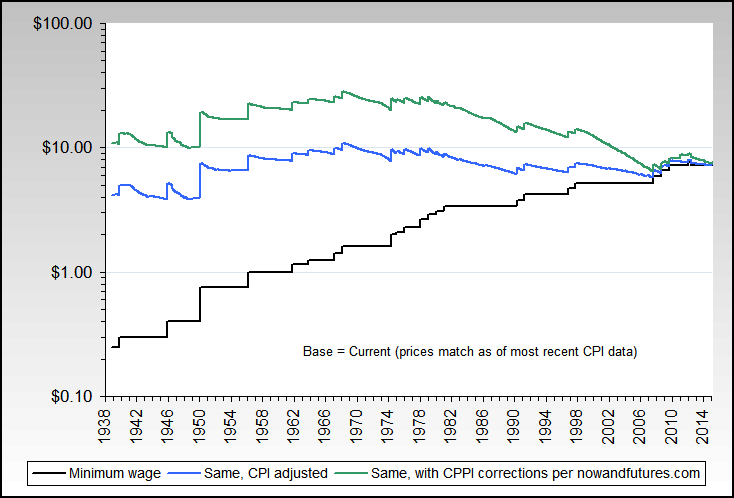

Minimum wage

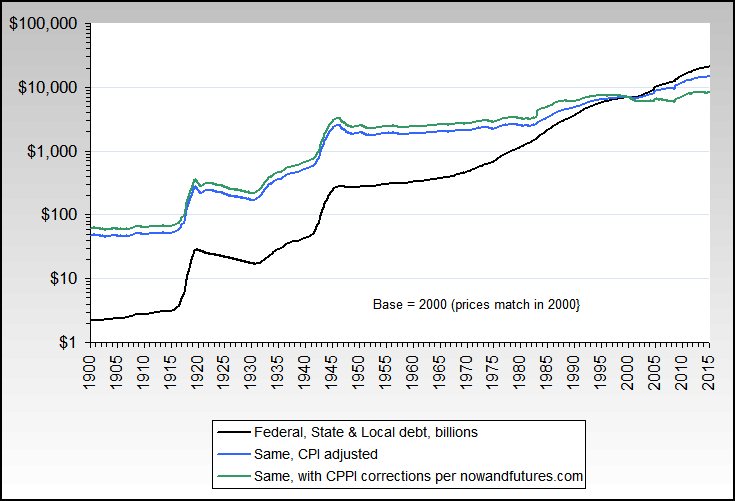

Federal, state & local debt

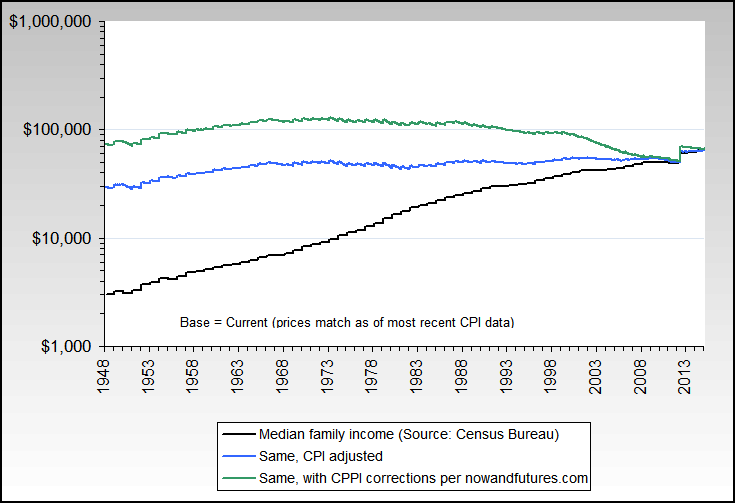

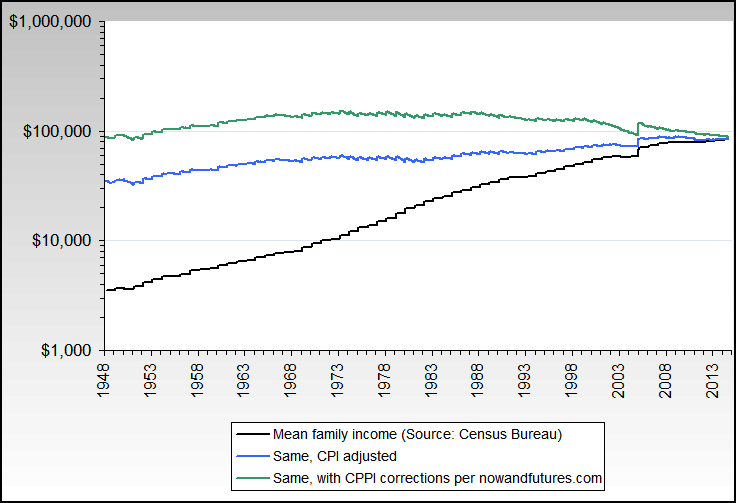

Median & mean family income

![]()