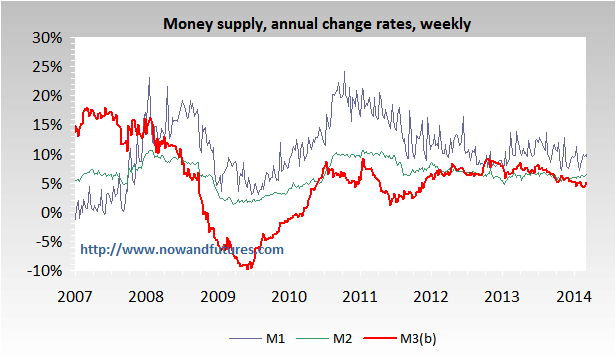

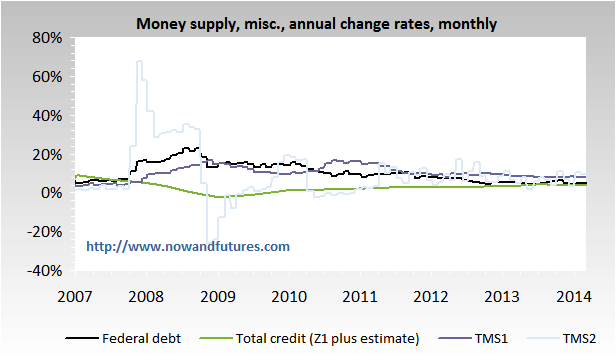

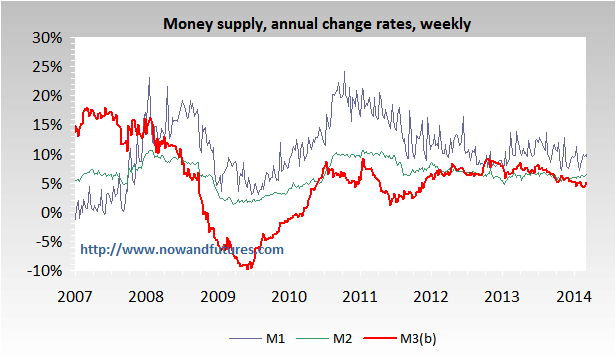

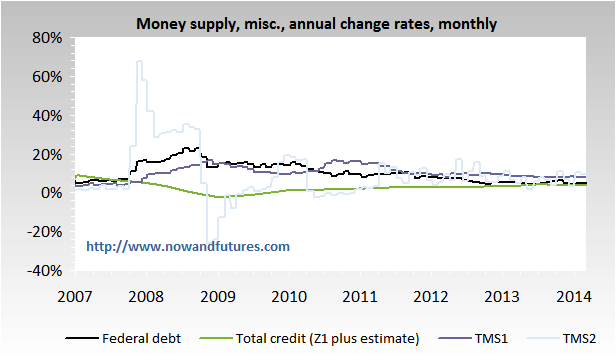

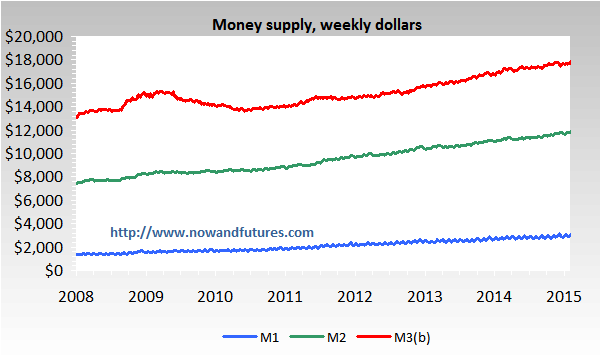

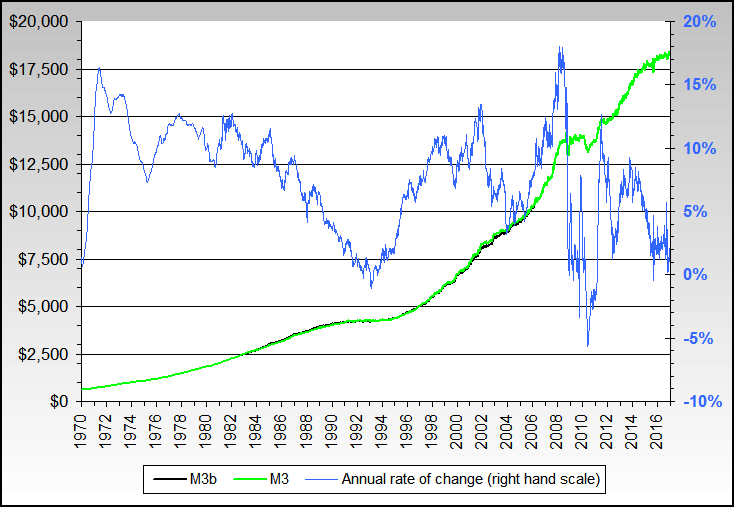

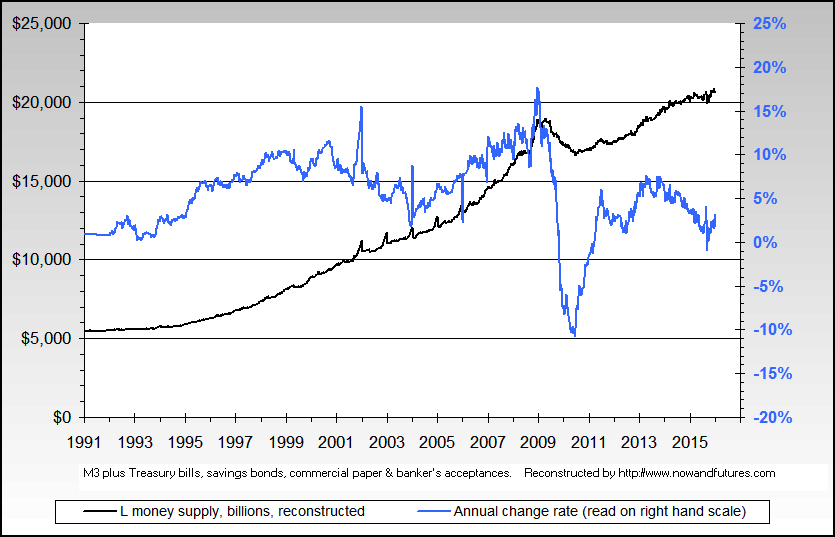

| Money supply M1, M2, M3 | TMS, Debt & Credit |

|---|---|

|

|

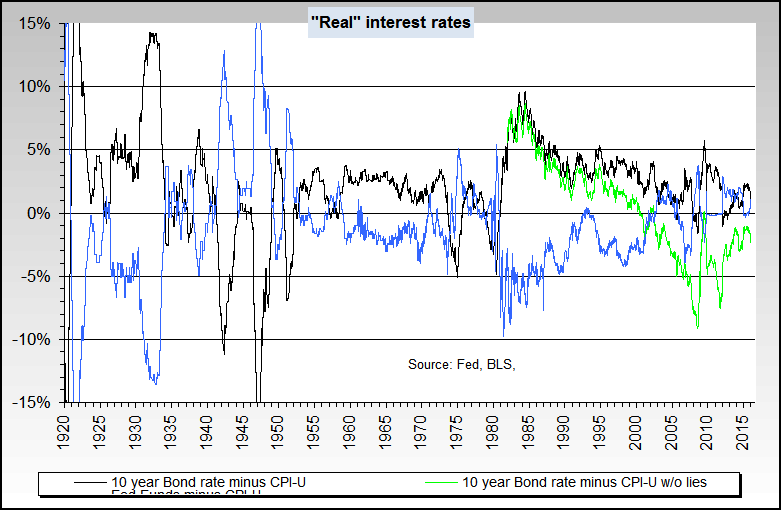

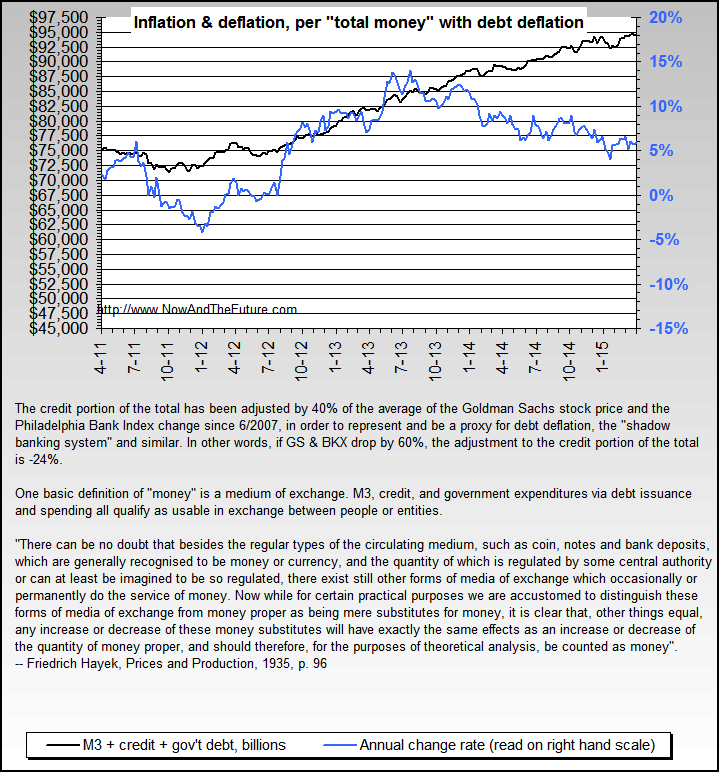

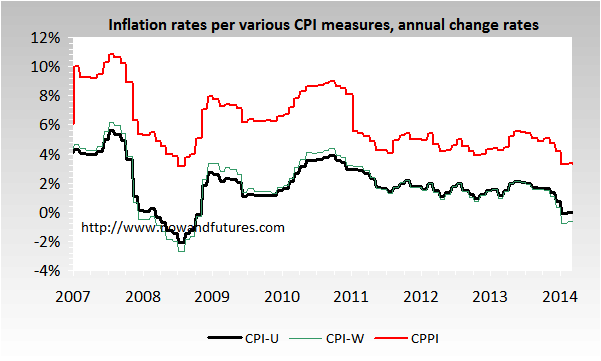

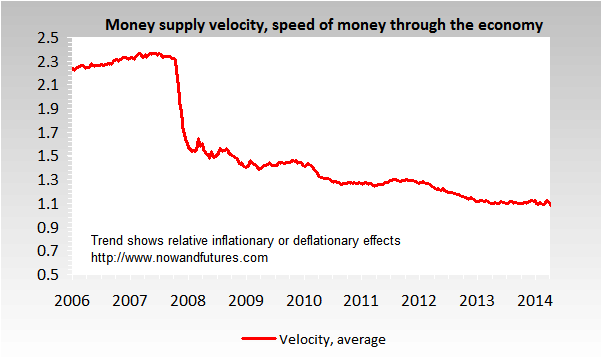

| Inflation | Velocity |

|---|---|

|

|

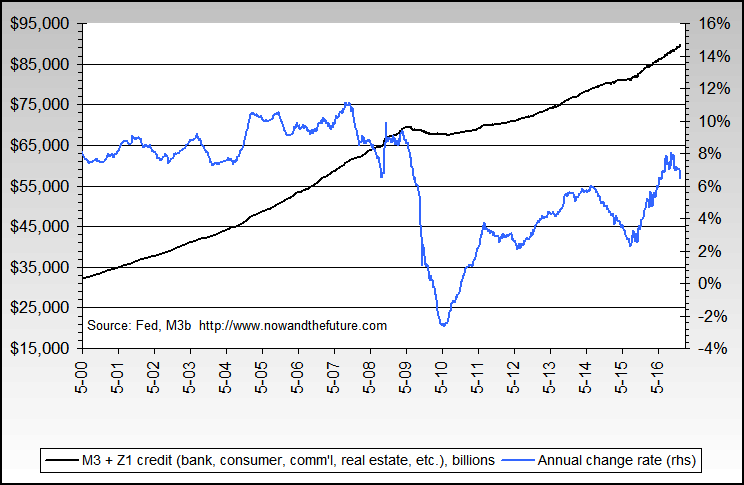

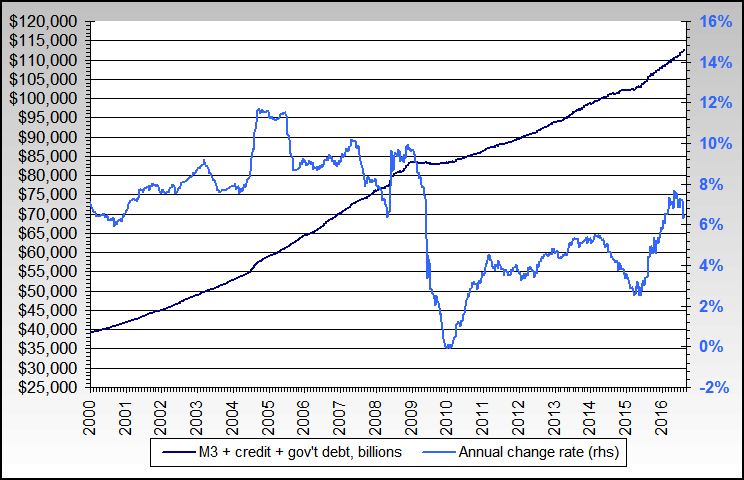

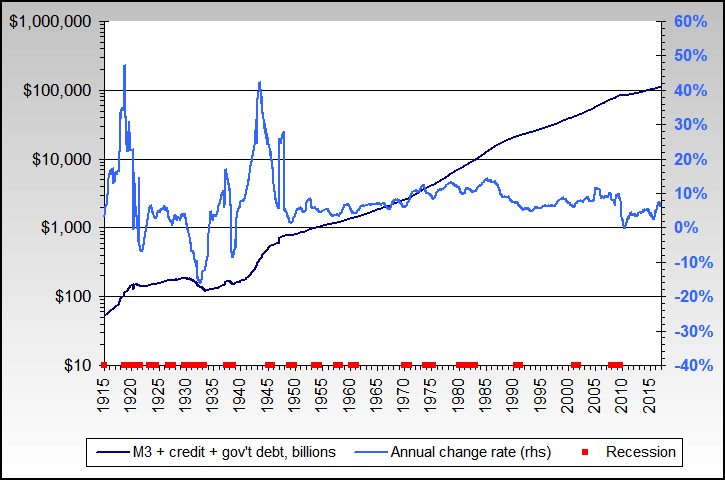

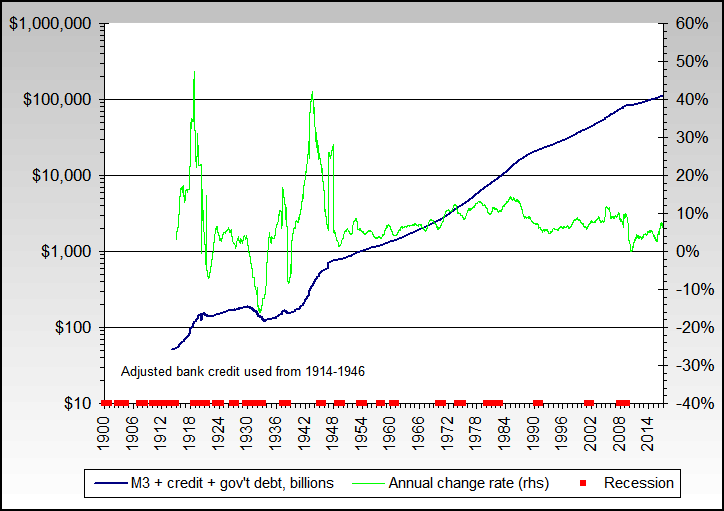

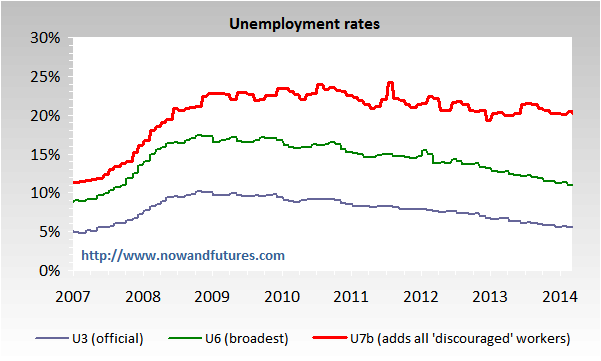

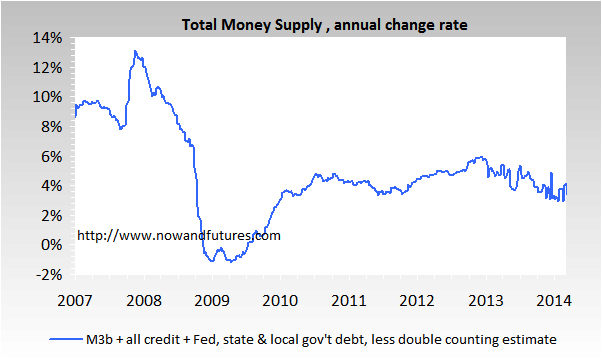

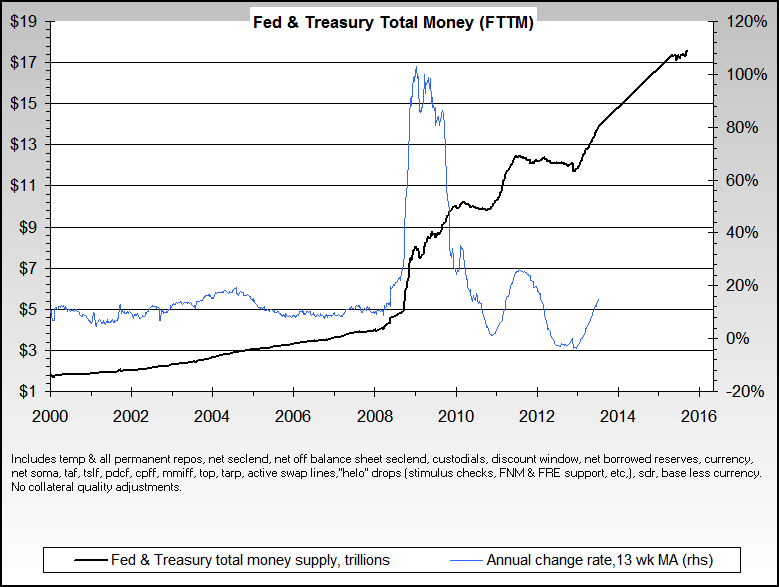

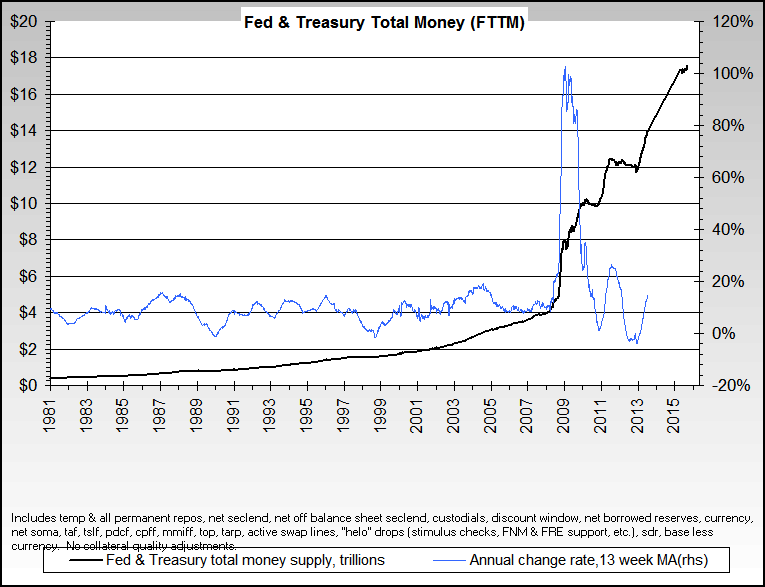

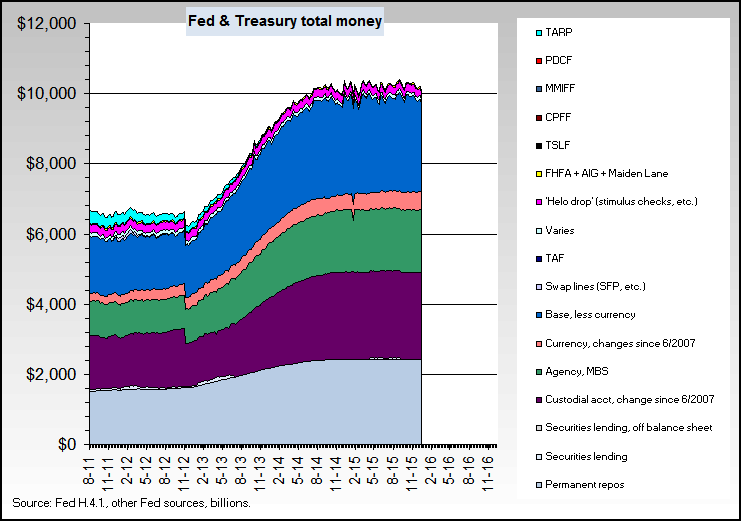

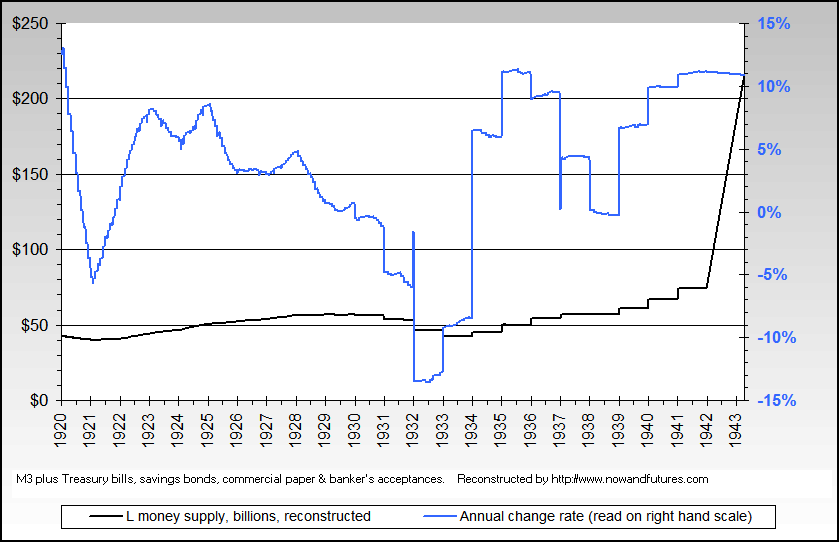

| Unemployment | Total Money Supply |

|---|---|

|

|

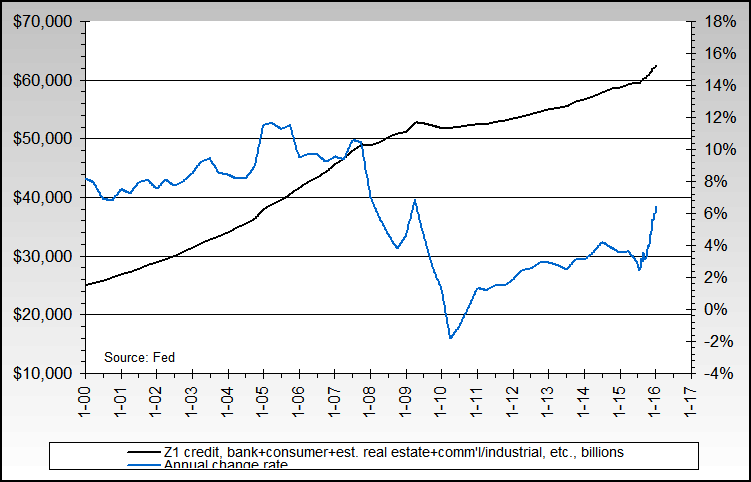

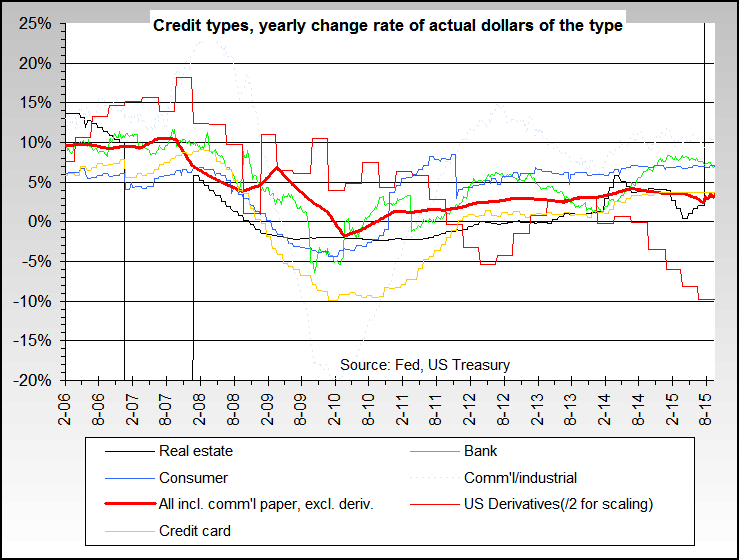

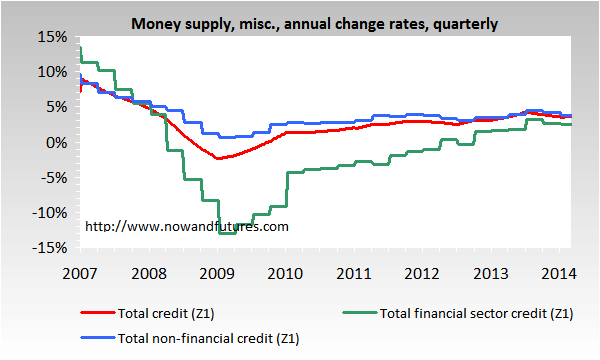

| Total credit, with sectors | Money supply values |

|---|---|

|

|

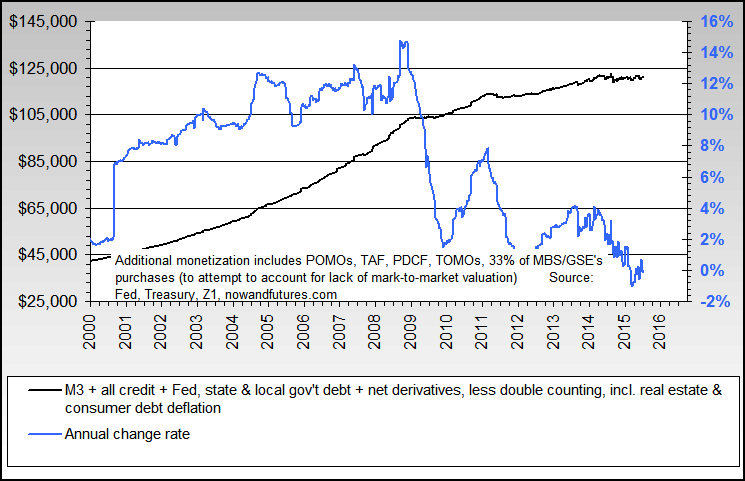

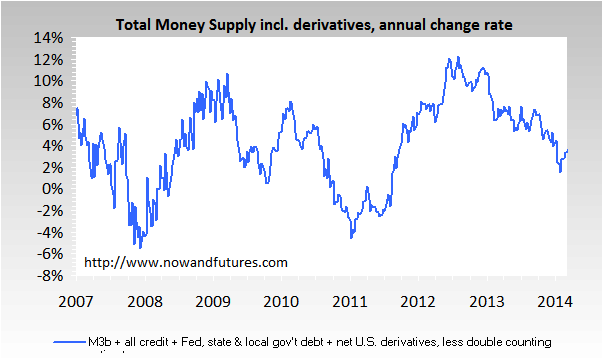

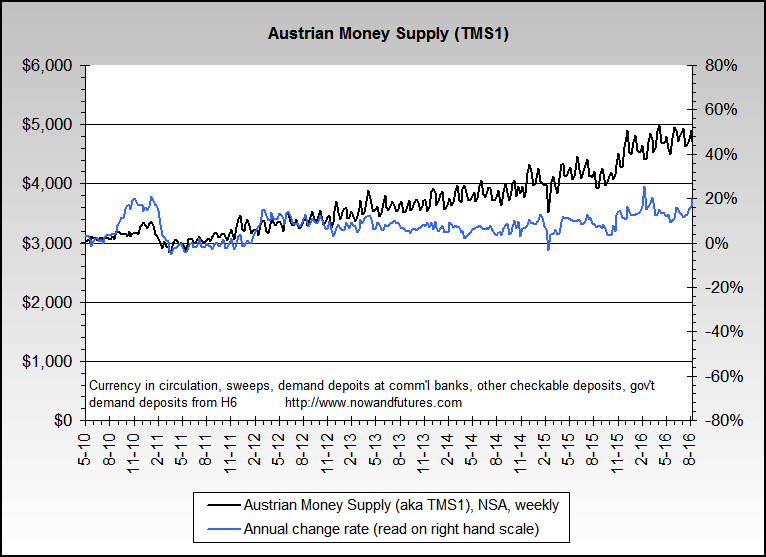

| Total money supply, w/deriv. | Austrian AMS (TMS1) weekly |

|---|---|

|

|

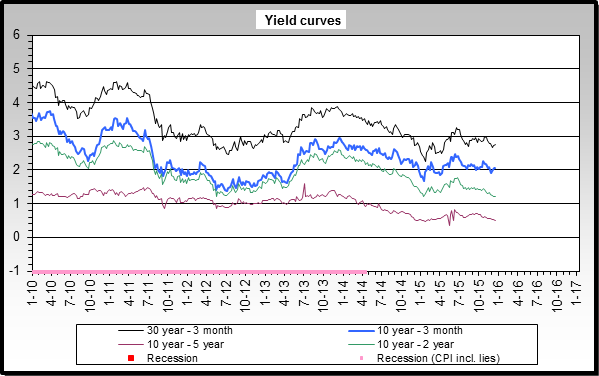

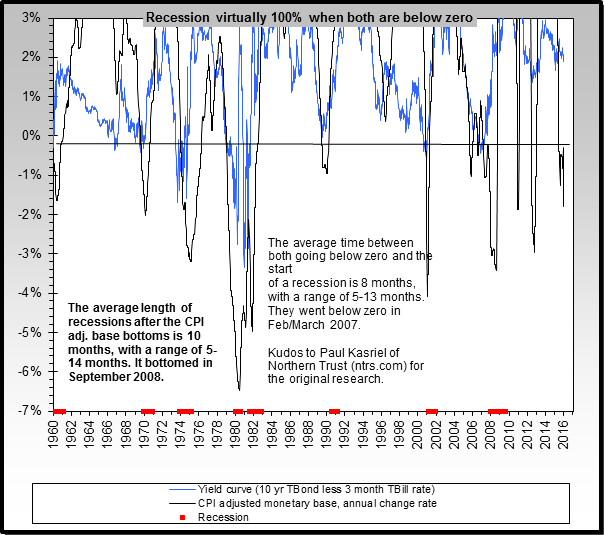

| Recession probability | Yield spread - 10 year & 3 month Treasuries (burgundy line in chart below) |

Recession probability, adjusted ** | ||

|---|---|---|---|---|

| 5% | +1.21 | 30-35% | ||

| 10% | +0.76 | 35-40% | ||

| 15% | +0.46 | 40-45% | ||

| 20% | +0.22 | 45-50% | ||

| 25% | +0.02 | 50-55% | ||

| 30% | -0.17 | 55-60% | ||

| 40% | -0.50 | 65-70% | ||

| 50% | -0.82 | 75-80% | ||

| 60% | -1.13 | 85-90% | ||

| 70% | -1.46 | 95-100% | ||

| 80% | -1.85 | 100% | ||

| 90% | -2.40 | 100% |